Issuing governance NFTs within decentralized organizations is rapidly becoming a cornerstone for formalizing participation, voting rights, and contributor recognition in web3 communities. Yet as DAOs and blockchain projects embrace these innovative tools, the legal terrain remains complex and often ambiguous. For founders, contributors, and community managers alike, understanding the legal considerations for governance NFTs is not just prudent, it’s essential to foster trust and long-term sustainability.

Legal Status and Liability: Navigating the Uncharted

The legal status of DAOs is a moving target. In most jurisdictions, DAOs lack clear recognition as corporate entities. This means that token holders may inadvertently be treated as partners in an unincorporated association, exposing themselves to joint and several liability for the DAO’s actions or debts. Wyoming has taken a pioneering step by recognizing DAOs as legal entities with specific legislation, providing some clarity for organizations operating within that state (source). However, this is far from universal, most regions offer little to no precedent or protection.

Without a legal wrapper or formal structure, participants risk personal liability for everything from intellectual property disputes to contract breaches. As such, many DAOs are exploring the creation of LLCs or similar wrappers to shield members from direct exposure while still maintaining decentralized governance models.

Securities Regulation: Are Governance NFTs Securities?

One of the most pressing issues in DAO NFT regulation is whether governance NFTs qualify as securities under existing laws. The U. S. Securities and Exchange Commission (SEC) applies the Howey Test, a four-pronged analysis examining investment intent, to determine if a token falls under its jurisdiction. If governance badges are deemed securities, they could trigger registration requirements or enforcement actions against both issuers and holders (source).

This regulatory uncertainty has led many projects to seek specialized legal counsel before launching NFT-based voting systems or reward programs. Developers must carefully consider whether their governance NFTs confer financial benefits or profit expectations, key factors in securities classification.

Key Legal Risks When Issuing Governance NFTs

-

Uncertain Legal Status and Liability: The lack of uniform legal recognition for DAOs can expose governance NFT holders to personal liability, especially in jurisdictions where DAOs are treated as general partnerships. Only a few places, such as Wyoming, have enacted legislation granting DAOs legal entity status.

-

Securities Regulation Risks: Governance NFTs may be classified as securities under U.S. law if they meet the Howey Test criteria, potentially triggering SEC oversight and registration requirements.

-

Intellectual Property Uncertainties: Failing to secure clear IP rights for underlying smart contracts or NFT content can result in legal disputes, particularly in cases involving generative art or open-source code.

-

Data Privacy Compliance: Governance NFTs may contain or link to personal data, making compliance with regulations like the GDPR in the EU essential to avoid penalties for mishandling user information.

-

Taxation Complexities: Issuing governance NFTs can create income, capital gains, and withholding tax obligations. Failure to address these can result in unexpected liabilities and regulatory scrutiny.

-

Environmental and Ethical Concerns: The energy consumption of blockchain networks used for NFTs can raise sustainability issues, potentially leading to reputational damage if not addressed transparently.

-

Smart Contract and Security Vulnerabilities: Coding errors or exploits in smart contracts can lead to theft or manipulation of governance NFTs, emphasizing the need for robust security audits and best practices in key management.

Intellectual Property Rights: Who Owns What?

Beyond regulatory compliance, intellectual property (IP) rights present another layer of complexity for decentralized organizations issuing governance badges. The underlying code of smart contracts, generative artwork used on badges, or even proprietary voting logic can all raise questions about ownership and licensing.

Failure to secure clear IP rights can result in costly disputes, especially when contributors come from diverse jurisdictions with varying copyright laws (source). Best practice dictates that DAOs establish explicit agreements regarding code contributions, creative assets, and badge designs before minting any NFTs linked to their governance processes.

Data Privacy Regulations: GDPR and Beyond

NFTs may contain metadata linking back to personal information about creators or previous owners, names, emails, transaction histories, which triggers obligations under data protection laws like the European Union’s General Data Protection Regulation (GDPR). Organizations must ensure that any personal data embedded within NFT transactions is handled according to applicable privacy statutes (source). This includes offering transparency around data use and ensuring mechanisms exist for individuals to exercise their rights regarding personal information.

Taxation is another area where legal clarity is still evolving. The act of issuing, transferring, or selling governance NFTs may trigger a range of tax consequences for both DAOs and individual participants. Depending on the jurisdiction, these activities could be treated as income events or capital gains, potentially subject to reporting requirements and tax liabilities. For DAOs with global membership, the patchwork of international tax laws adds an extra layer of complexity. Engaging with accountants or legal advisors familiar with NFT compliance is critical for minimizing exposure and ensuring that all parties understand their obligations.

Environmental and Ethical Considerations: Sustainability in Governance NFT Issuance

The environmental impact of blockchain activity remains a contentious issue, particularly for organizations seeking to demonstrate responsible stewardship. Many blockchains that support NFTs are energy-intensive, raising questions about carbon footprints and long-term sustainability practices. DAOs issuing governance badges must weigh these concerns, especially as public scrutiny intensifies and regulatory bodies begin to consider environmental disclosures as part of broader compliance frameworks (source). Adopting eco-friendly chains or offsetting emissions can help mitigate reputational risk and align DAO values with those of environmentally conscious stakeholders.

Security Risks: Protecting Assets and Reputations

Smart contracts are not immune to bugs or exploits, security lapses can result in stolen assets or manipulated voting outcomes. For governance NFTs, this risk is twofold: not only could attackers compromise valuable badges, but they might also undermine the integrity of decentralized decision-making itself. Best practices include rigorous code audits, multi-factor authentication for key accounts, and robust private key management protocols (source). Platforms should prioritize transparency around security measures and encourage community vigilance against evolving threats.

Essential Steps to Secure Governance NFT Smart Contracts

-

Conduct Comprehensive Smart Contract Audits – Engage reputable blockchain security firms such as ConsenSys Diligence or Trail of Bits to perform thorough code reviews and vulnerability assessments before deployment.

-

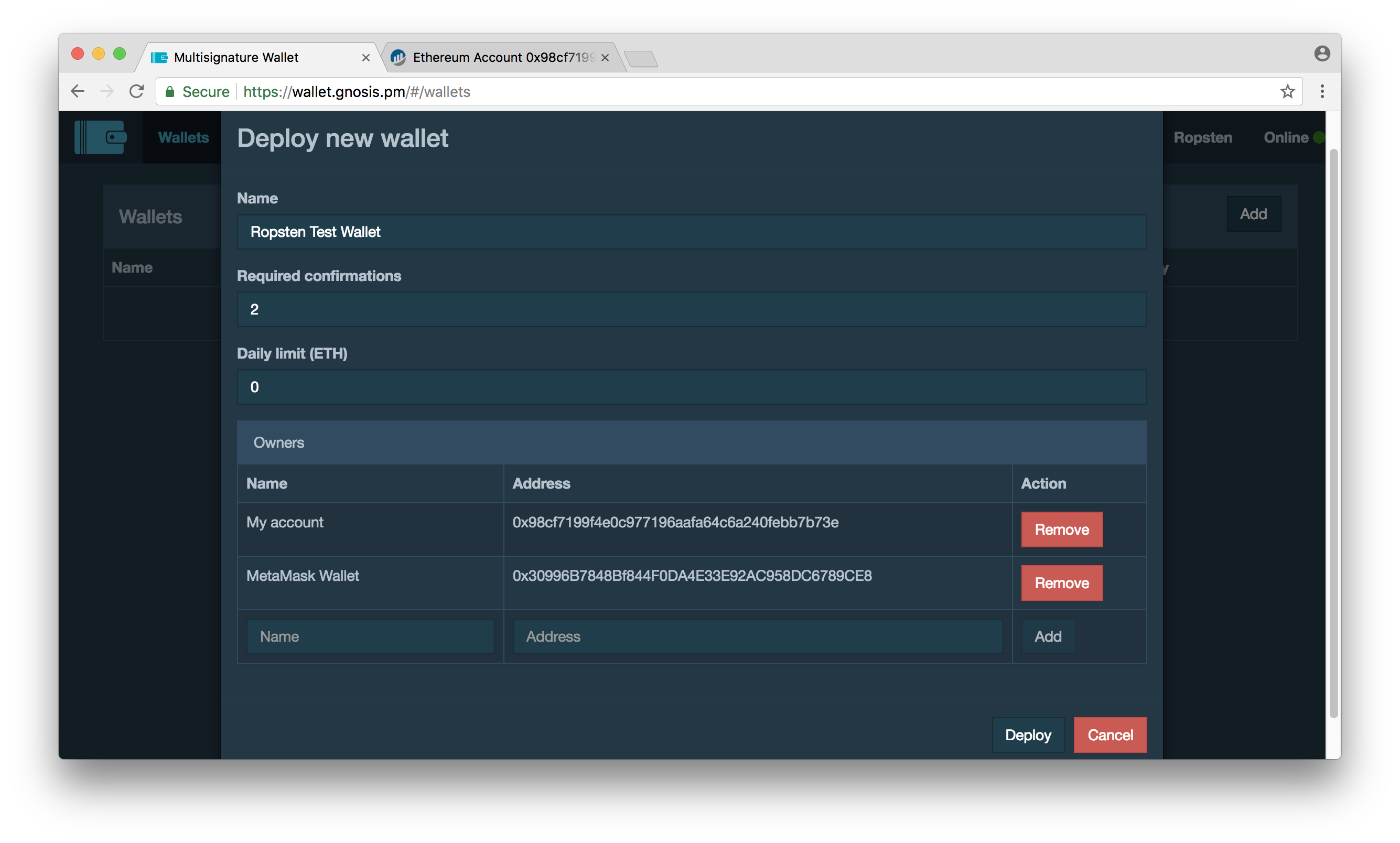

Implement Multi-Signature Wallets – Use established multi-signature solutions like Gnosis Safe to manage contract upgrades and treasury actions, reducing single-point-of-failure risks.

-

Enforce Role-Based Access Controls – Integrate robust access control libraries such as OpenZeppelin AccessControl to restrict sensitive functions and limit administrative privileges.

-

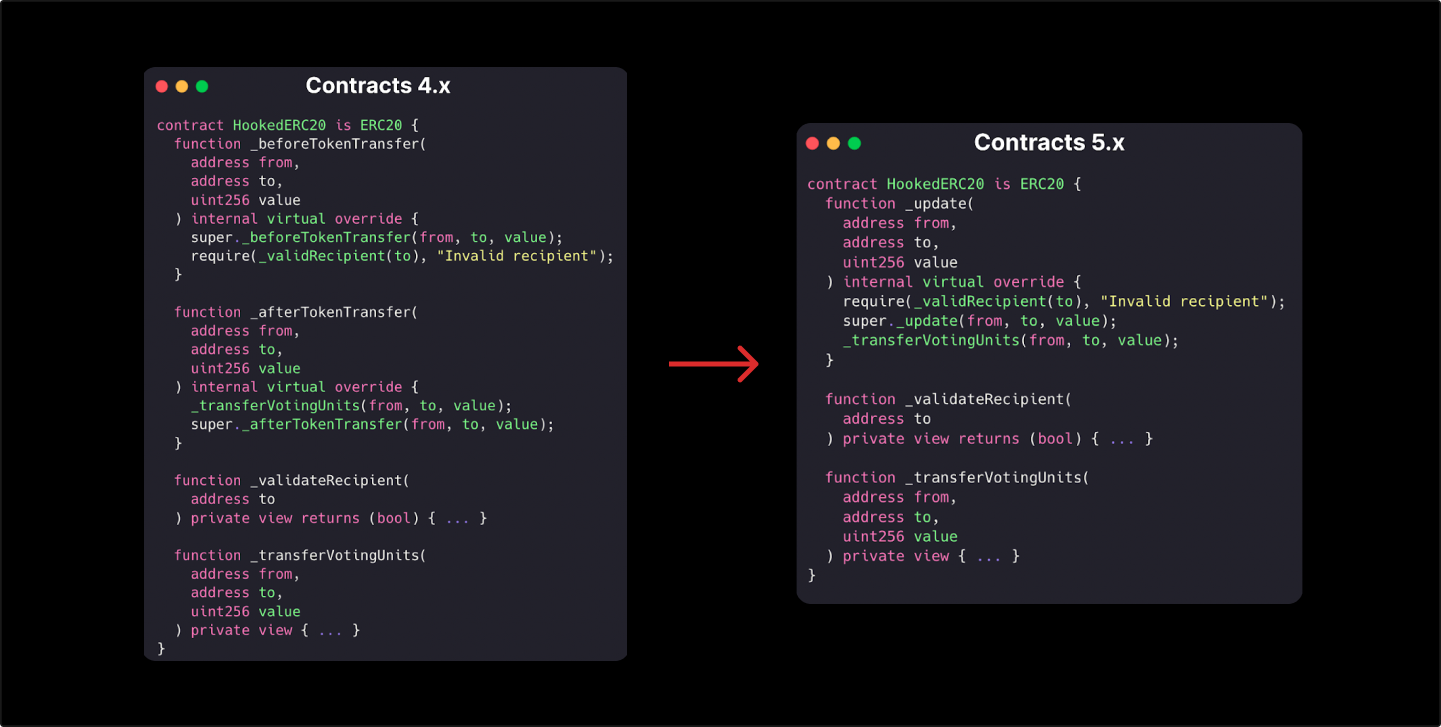

Adopt Upgradable Smart Contract Frameworks – Utilize proven frameworks like OpenZeppelin Upgrades to enable secure contract updates while maintaining transparency and auditability.

-

Establish Incident Response Procedures – Prepare for potential exploits by setting up clear incident response plans, including partnerships with platforms like Immunefi for bug bounty programs and rapid vulnerability disclosure.

-

Ensure Legal Compliance and Documentation – Collaborate with legal counsel experienced in blockchain (e.g., Cooley LLP) to draft terms of use, privacy policies, and ensure compliance with securities, IP, and data protection regulations.

Practical Steps for DAO Founders

Given the rapidly shifting landscape of decentralized organizations law, proactive risk management is essential. Here are actionable strategies for DAO founders:

- Establish a legal wrapper: Form an LLC or similar entity in a favorable jurisdiction to limit personal liability.

- Engage experienced counsel: Work with lawyers specializing in blockchain regulation and NFT compliance.

- Define IP ownership early: Use contributor agreements to clarify rights over code, artwork, and badge designs.

- Implement privacy safeguards: Audit metadata for personal information and comply with global data protection laws.

- Assess tax implications: Consult tax professionals on reporting obligations at both organizational and individual levels.

- Pursue sustainability: Choose environmentally friendly blockchains or adopt carbon offset strategies where feasible.

- Prioritize security: Regularly audit smart contracts, educate members on wallet safety, and use multi-factor authentication.

Navigating the legal considerations surrounding governance NFTs isn’t just about checking boxes, it’s about building trust within your community while future-proofing your organization against regulatory shocks. As lawmakers catch up with innovation, DAOs that prioritize legal clarity will be best positioned to thrive in an increasingly complex ecosystem.