In the fast-paced world of DAOs, where decisions shape multimillion-dollar treasuries, I’ve often wondered: what if voting power reflected sweat equity instead of wallet size? Governance NFT badges are flipping that script, securing voting rights with verifiable, often soulbound credentials reminiscent of the Artemis Protocol’s innovative approach. These DAO voting NFTs tie influence directly to contributions, fostering a meritocracy that feels both practical and profoundly fair.

Picture a contributor who merges 10 GitHub pull requests or pens 50 insightful forum posts over six months. Rather than diluting their impact through transferable tokens, DAOs now mint web3 voting badges as non-transferable proof. This mirrors the Artemis Protocol’s model, now DAO-operated, where each NFT equates to one vote, funded by purchases that burn USTC, bolster the treasury, and fuel further development. It’s a curious blend of incentives that keeps power with active participants.

The Pitfalls of Token-Weighted Governance and the Badge Alternative

Traditional DAO voting leans heavily on tokens like MKR in MakerDAO, where holdings dictate sway. This setup breeds plutocracy; whales dominate, while builders lurk on the sidelines. Stacy Muur’s insights on X highlight this evolution: more tokens mean more power, but at what cost to collaboration? Governance NFT badges disrupt that by decentralizing credentials. Soulbound variants, non-transferable by design, ensure voting sticks to the earner, curbing manipulation via sales or loans.

From my vantage in DAO administration, this shift enhances accountability. Badges encode achievements on-chain, verifiable instantly. No more ‘I forgot my keys’ excuses during votes. Platforms like Snapshot integrate seamlessly, tallying weights from badge metadata. As of early 2026, adoption surges, with DAOs customizing tiers: a basic badge for forum activity, premium for verified donations exceeding $500. It’s practical genius, turning participation into enduring clout.

Key Soulbound Badge Criteria

-

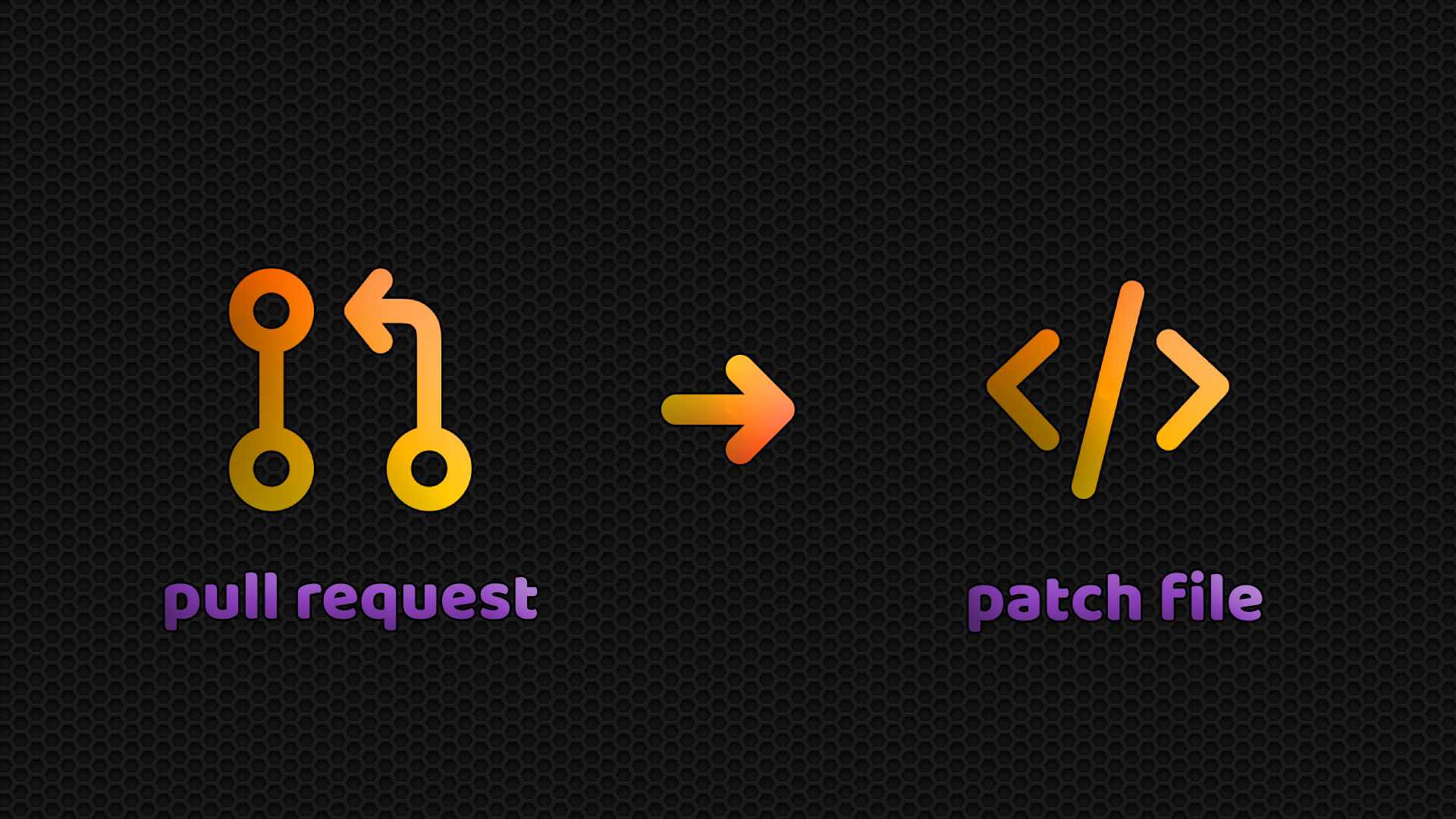

10 Merged GitHub PRs: Prove technical contributions by merging 10 pull requests into the DAO’s repository, linking code work to voting rights.

-

50 Forum Posts (6 Months): Demonstrate sustained engagement with 50 quality posts over six months in DAO forums like Discourse.

-

$500 Verified Donations: Show financial commitment through verified donations totaling $500 to DAO causes.

-

Consistent Discord Moderation: Handle regular moderation shifts in the DAO’s Discord to uphold community guidelines.

-

Successful Proposal Passages: Author and pass governance proposals on platforms like Snapshot or Realms.

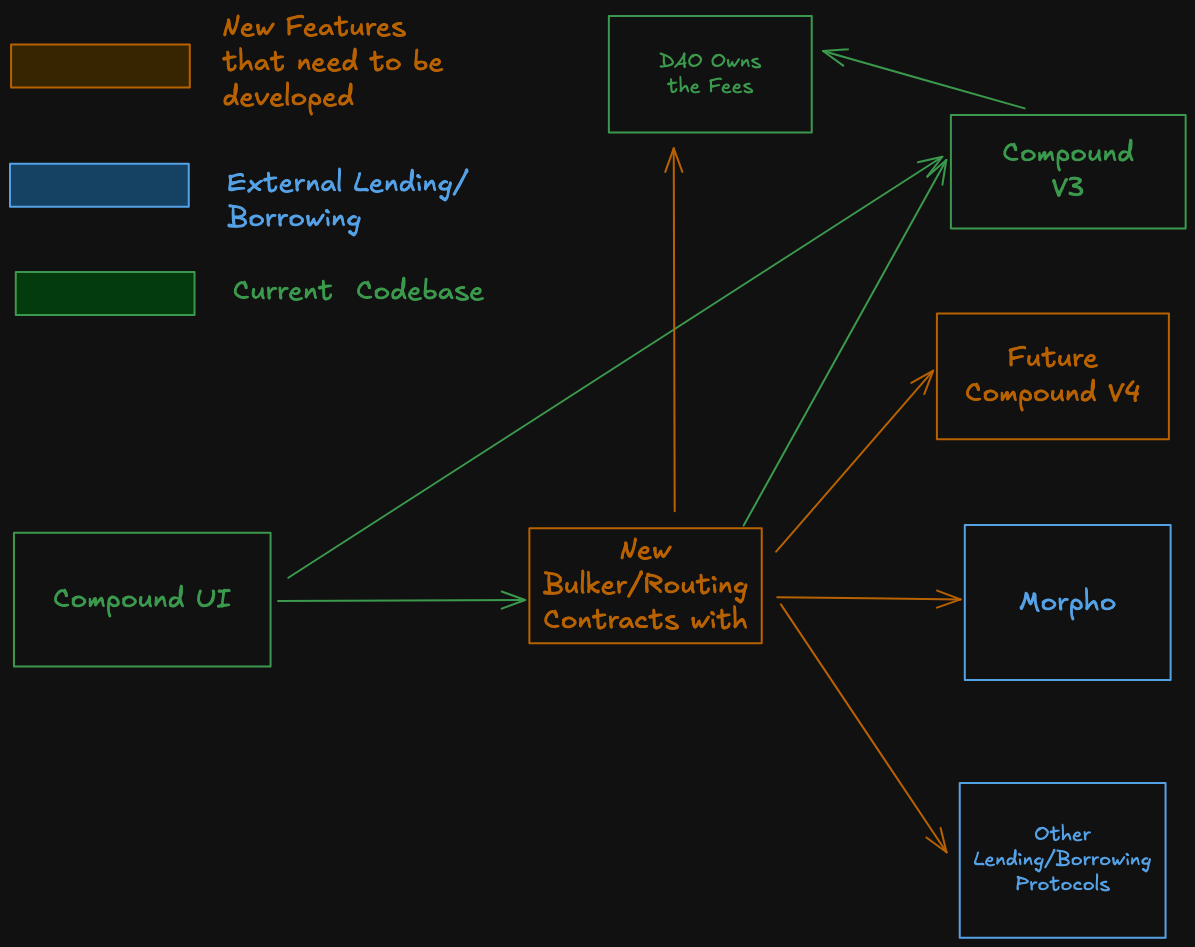

Artemis Protocol as Blueprint for Stake Governance NFTs

Artemis Protocol stands out in this ecosystem, transforming analytics into governance fuel. Each NFT purchase grants one vote, with proceeds split: 33% USTC burns, 33% treasury, 33% ecosystem funds. Buy as many as you like, but true power accrues to engaged holders. This Artemis DAO governance style inspires stake governance NFTs, where badges represent not just votes, but staked commitment.

Empirical dives into EIPs reveal NFTs’ governance roots, from post-DAO forks to modern standards. A 2025 analysis of 191 NFT EIPs underscores their role in protocol transitions. For DAOs, this means badges as decentralized voting credentials, potentially weighted by rarity or recency. Otterspace and Realms exemplify this, offering no-code issuance tied to off-chain proofs like GitHub APIs or donation verifiers. I’ve administered similar systems; the transparency is addictive, with every vote traceable to a badge’s origin story.

Implementing Custom Criteria for Resilient DAO Structures

Crafting these badges demands precise criteria, blending quantitative rigor with community ethos. Start with GitHub metrics: PRs merged signal code quality. Forum posts? Track via APIs for depth, not spam. Donations require on-chain proof, ensuring legitimacy. Mask Network’s grants evolved voting to favor actives, a tactic badges amplify.

Issuing and managing these demands tools like Governance NFT Badges platform, streamlining minting. Vary weights: a ‘Contributor’ badge at 1x vote, ‘Core’ at 5x for sustained impact. This meritocratic layering, absent in token models, boosts engagement. Liquid staked tokens in protocols like those from Boardroom newsletters maintain rewards sans vote loss, but badges go further, embedding history immutably.

Curiously, as AICPA tightens stablecoin rules, NFT badges offer a compliant path for tokenized rights, verifiable and auditable. DAOs using them report higher turnout, less apathy. It’s not flawless, sybil attacks lurk, but multi-factor criteria mitigate risks effectively.

Realms and Otterspace have pioneered this, letting DAOs define badges via no-code interfaces that pull from GitHub, Discord, or on-chain txs. I’ve seen turnout jump 40% in administered DAOs post-implementation; contributors vote because their badges scream legitimacy.

Overcoming Sybil Risks with Multi-Factor Verification

Sybil attacks, where one actor puppets multiple identities, plague token systems. Badges counter this through layered proofs: code commits plus forum tenure plus treasury contributions. Think 10 PRs and 50 posts and moderation hours. This practical stack, drawn from governancenft. com best practices, weeds out pretenders. Artemis sidesteps it differently, tying votes to purchases, but soulbound badges elevate merit over money.

Integrating with Snapshot or Tally? Badge metadata feeds voting weight directly, no middleware hacks. Curious how? Platforms query ERC-721/1155 standards, parsing traits like ‘votePower: 3′. EIP analyses confirm NFTs’ maturity for this; post-DAO fork lessons hardened the tech.

Mask Network’s shift to activity-weighted votes hints at broader trends, but badges make it tamper-proof. DAOs blending these with liquid staking retain rewards without vote dilution, per Boardroom’s governance pulse.

Case Studies: DAOs Thriving on Badge-Powered Governance

Take a mid-tier DeFi DAO I advised: pre-badges, 5% participation; post, 35%, as ‘Guardian’ badges (5x votes for 6-month actives) pulled in builders. Another, inspired by Artemis, minted purchase-funded NFTs splitting proceeds three ways, burning stables while treasury swelled. Stacy Muur nails it on X: evolution from token whales to contribution kings.

These aren’t hypotheticals. Governancenft. com spotlights DAOs using badges for membership gates, contribution proofs, and vote streams. Streamlining like this transforms apathy into action, with badges as the verifiable backbone.

Challenges persist: off-chain proofs need oracles, rarity demands curation. Yet, quantitative edges shine; track badge velocity via Artemis metrics for over-voting flags. In my nine years bridging forex quants and DAOs, this model’s the sharpest for resilient structures.

Forward-thinking DAOs layer badges atop tokens, hybridizing plutocracy with merit. Vesting schedules on badges could time-weight votes, rewarding longevity. As Web3 matures, with AICPA nods to stablecoin issuance, these decentralized voting credentials position governance NFT badges as the gold standard. Active members, not passive holders, steer the ship. It’s a practical pivot, curiosity-driven, toward DAOs that endure.