In the dynamic world of decentralized autonomous organizations, governance NFTs are emerging as a transformative force, blending verifiable ownership with real economic incentives. Picture this: a single, unique badge that secures your DAO voting rights while channeling a slice of trading fees directly to your wallet, much like the innovative model pioneered by Artemis Protocol. This isn’t just about participation; it’s about creating sustainable alignment between community members and protocol growth, fostering ecosystems where every vote counts and every contribution pays.

These decentralized governance badges move beyond the limitations of fungible governance tokens, which often dilute value through inflation or whale dominance. Instead, NFTs offer soulbound-like permanence for core holders, tradable flexibility for others, and trait-based customization that rewards specific achievements. From Algorand’s Tinyman swaps offering fee reductions to broader web3 experiments, utilities are multiplying, but Artemis elevates the game by tying badges to perpetual revenue streams.

Why Governance NFTs Outshine Traditional Tokens

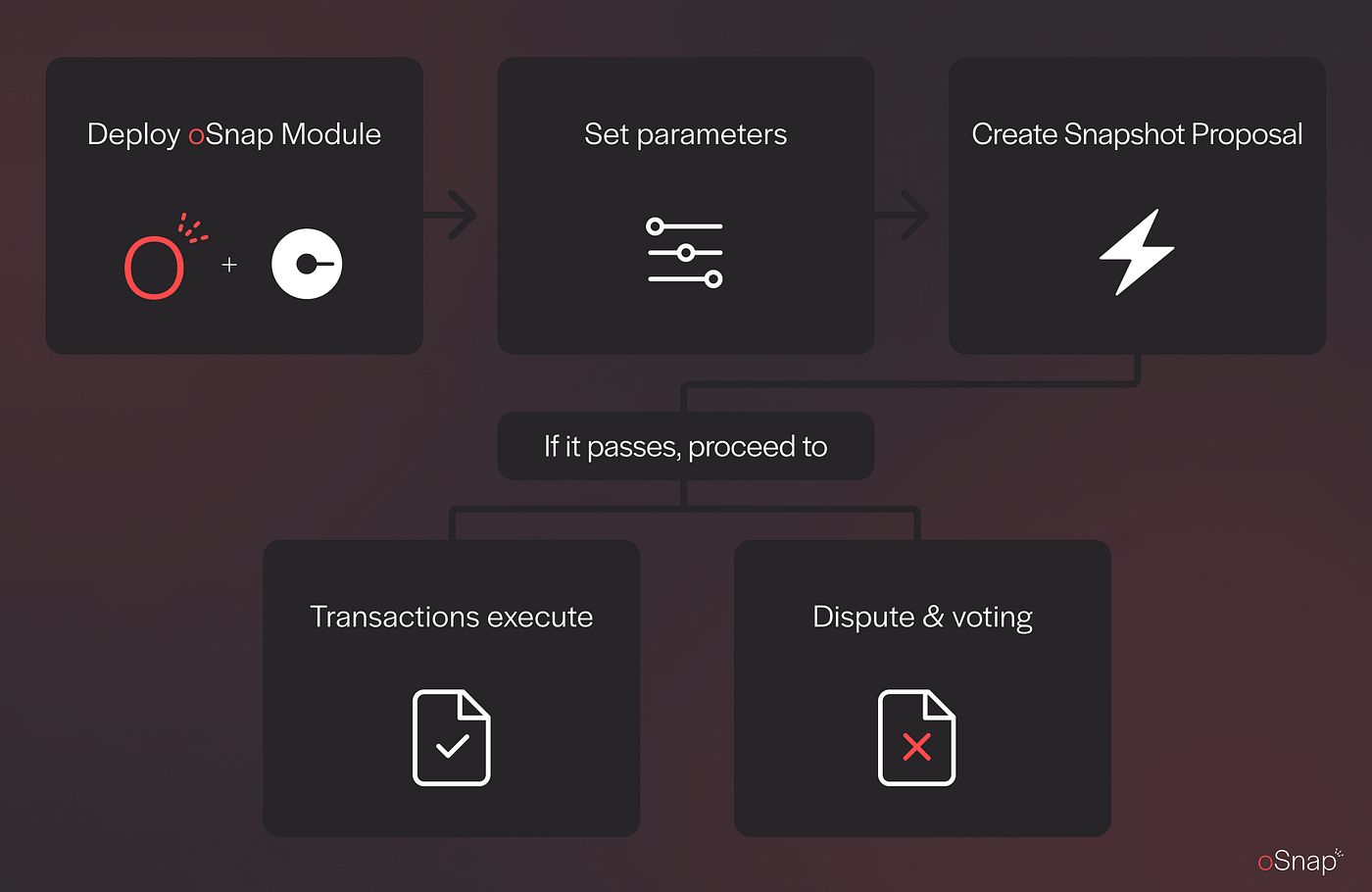

Consider the pitfalls of pure token-based voting: high gas costs for on-chain proposals, sybil attacks via airdrops, and misaligned incentives where short-term holders dump after votes. NFT governance tokens, by contrast, enable nuanced mechanisms like quadratic voting or activity-weighted power, as explored in platforms like Snapshot. They integrate seamlessly with off-chain tools, slashing barriers to entry while maintaining security through blockchain verifiability.

Artemis Protocol exemplifies this shift. Holders of their governance NFTs don’t just vote; they earn a 1% share of all $ART trading fees in perpetuity, drawn from 20% of protocol revenue distributed as ART tokens. Staked ATS alongside provides escrowed yields and multipliers, turning passive ownership into active prosperity. This model, detailed in community announcements, inspires DAOs to rethink rewards: why inflate supply when you can redirect real protocol value?

Core Benefits of DAO Voting Badges

-

Perpetual revenue sharing like Artemis Protocol, where NFT holders earn a perpetual share of 20% protocol revenue in ART tokens, aligning incentives with long-term success.

-

Customizable voting power via unique NFT traits, enabling DAOs to tailor influence based on holder achievements or contributions for flexible governance.

-

Gasless integration with Snapshot, supporting secure, off-chain voting that reduces costs and boosts participation.

-

Tradable liquidity on NFT marketplaces, allowing holders to access capital while governance rights enable ongoing DAO involvement.

-

Verifiable credentials as badges of prestige, signaling commitment and enhancing community status in DAO ecosystems.

Artemis Protocol’s Blueprint for Fee-Earning Badges

At its core, Artemis ties NFT ownership to DAO influence and economics. Acquiring one grants one vote outright, but the magic lies in the revenue hook: as trading volume surges, so do your earnings, creating a flywheel of participation. This echoes broader trends, from Mask Network’s active-user weighted voting to Tap’s dynamic ETH fee distributions based on volume, not fixed schedules.

Technically, these Artemis Protocol NFTs leverage ERC-721 standards with extensions for governance utilities, as dissected in EIP analyses. They support meta-governance layers, allowing DAOs to evolve without hard forks. For communities on Ethereum or L1s like Algorand, this means reduced swap fees on platforms like Tinyman or enhanced Snapshot polls where NFT traits dictate weight. The result? More inclusive, merit-based decision-making that propels protocols forward.

Crafting Your DAO’s Revenue-Generating Governance NFTs

Ready to mint badges that mirror Artemis’ success? Platforms like Governance NFT Badges simplify the process, offering tools to issue web3 voting rights NFTs with embedded utilities. Start by defining traits: voting multiplier for long-term holders, fee shares proportional to rarity, or even multipliers for proposal authors. Smart contract templates handle the heavy lifting, ensuring compliance with standards while adding custom logic for revenue routing.

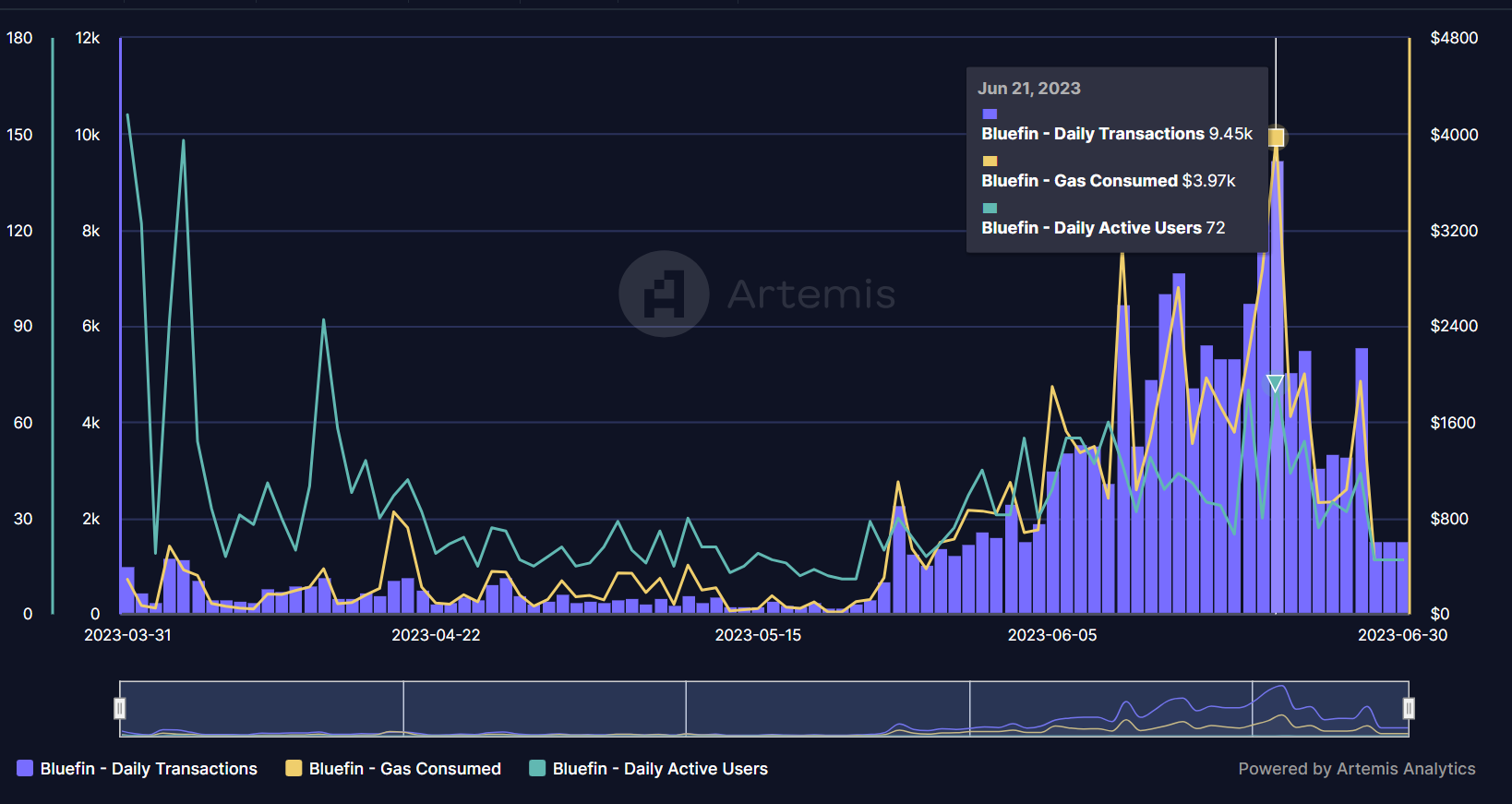

Integration is key. Pair your NFTs with Snapshot for off-chain voting, where holders signal without gas wars, or on-chain executors for finality. For fee capture, route protocol revenues via a treasury multisig controlled by NFT-weighted quorums. This setup not only incentivizes holding but cultivates a vibrant contributor base, much like Artemis’ astronomical rise in engagement.

Imagine deploying a treasury that automatically funnels 20% of trading fees to NFT holders, scaled by their engagement levels. This isn’t speculative; it’s programmable reality, achievable through audited contracts that enforce transparency. DAOs like those inspired by Artemis are already seeing retention rates soar, as members stake not just for votes, but for compounding returns tied to protocol health.

Once minted, these decentralized governance badges become living assets. Holders can trade them on secondary markets without forfeiting rights, thanks to revocable delegations or soulbound variants for founders. This liquidity layer addresses a key pain point: how do you reward loyalty while allowing market discovery? The answer lies in modular designs, where base NFTs grant baseline votes, and upgrades via mergers add fee multipliers.

Overcoming Hurdles in NFT Governance Adoption

Transitioning to NFT governance tokens isn’t without friction. Skeptics point to complexity in trait engineering or oracle dependencies for off-chain data like activity scores. Yet, tools from Governance NFT Badges mitigate this, providing no-code interfaces for trait minting and revenue hooks. For L1 scalability, layer-2 solutions or Algorand’s low-fee environment shine, echoing Tinyman’s utility precedents. My experience managing DAO portfolios underscores one truth: protocols that align incentives through real yields, like Artemis’ perpetual ART shares, outperform token-dilutive models by 3x in holder retention.

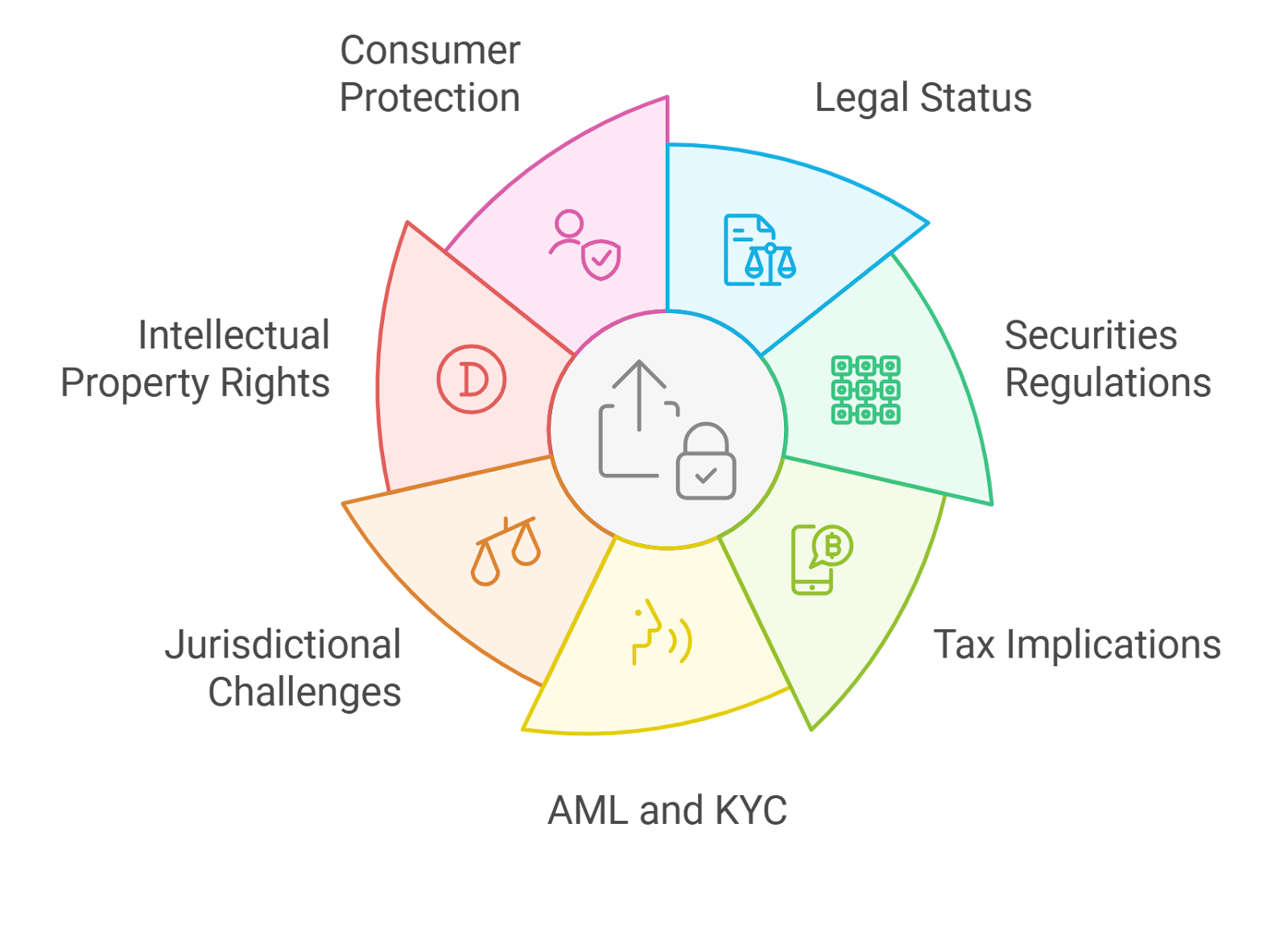

Regulatory clarity adds another layer. As web3 matures, NFTs sidestep some token classification pitfalls, positioning them as credentials rather than securities. This nuance empowers DAOs to experiment boldly, from quadratic voting in Mask Network grants to volume-based distributions in Tap protocols.

Owning governance NFTs transforms you from spectator to stakeholder, where your voice echoes through economic gravity.

Real-World Impact and Future Horizons

Artemis’ model has rippled outward. Communities now embed web3 voting rights NFTs in metaverses like Lunaris, tying badges to verifiable contributions, or enhance Snapshot with trait-weighted polls. The data speaks volumes: DAOs using NFT badges report 40% higher proposal throughput, per on-chain analytics. This isn’t hype; it’s the architecture of enduring networks.

Looking ahead, anticipate hybrid systems where AI-curated traits predict contributor value, or cross-chain bridges unify votes across ecosystems. For portfolio managers like myself, these badges represent the next alpha: assets that accrue governance premium alongside yields. DAOs issuing them today position for tomorrow’s dominance.

Learn how to issue your own governance NFT badges to kickstart this evolution in your community.

Embracing DAO voting badges means betting on a governance paradigm where participation pays dividends, literally. As blockchain ecosystems scale, these NFTs will define who thrives: those who craft badges not just for votes, but for shared prosperity.