In the evolving landscape of decentralized governance, governance NFT badges are redefining how DAOs allocate power and rewards. Picture this: instead of fleeting token votes, you hold a digital badge that secures your senate seat, complete with perpetual claims on trading fees. Artemis Protocol has turned this vision into reality, where each NFT not only delivers one DAO vote but also funnels 1% of all $ART trading fees straight to holders-forever. That’s 20% of total fees distributed this way, creating a stake-and-earn model that’s got web3 communities buzzing.

This isn’t just hype. DAOs like Artemis are blending DAO senate NFTs with real economic incentives, ensuring active participants reap ongoing benefits. Traditional governance tokens dilute over time, but these badges lock in value accrual through protocol revenue. It’s a practical shift toward sustainable participation, where your vote carries weight and your wallet sees steady drips from the ecosystem’s success.

Artemis Protocol’s Blueprint: Votes Plus Fee Shares

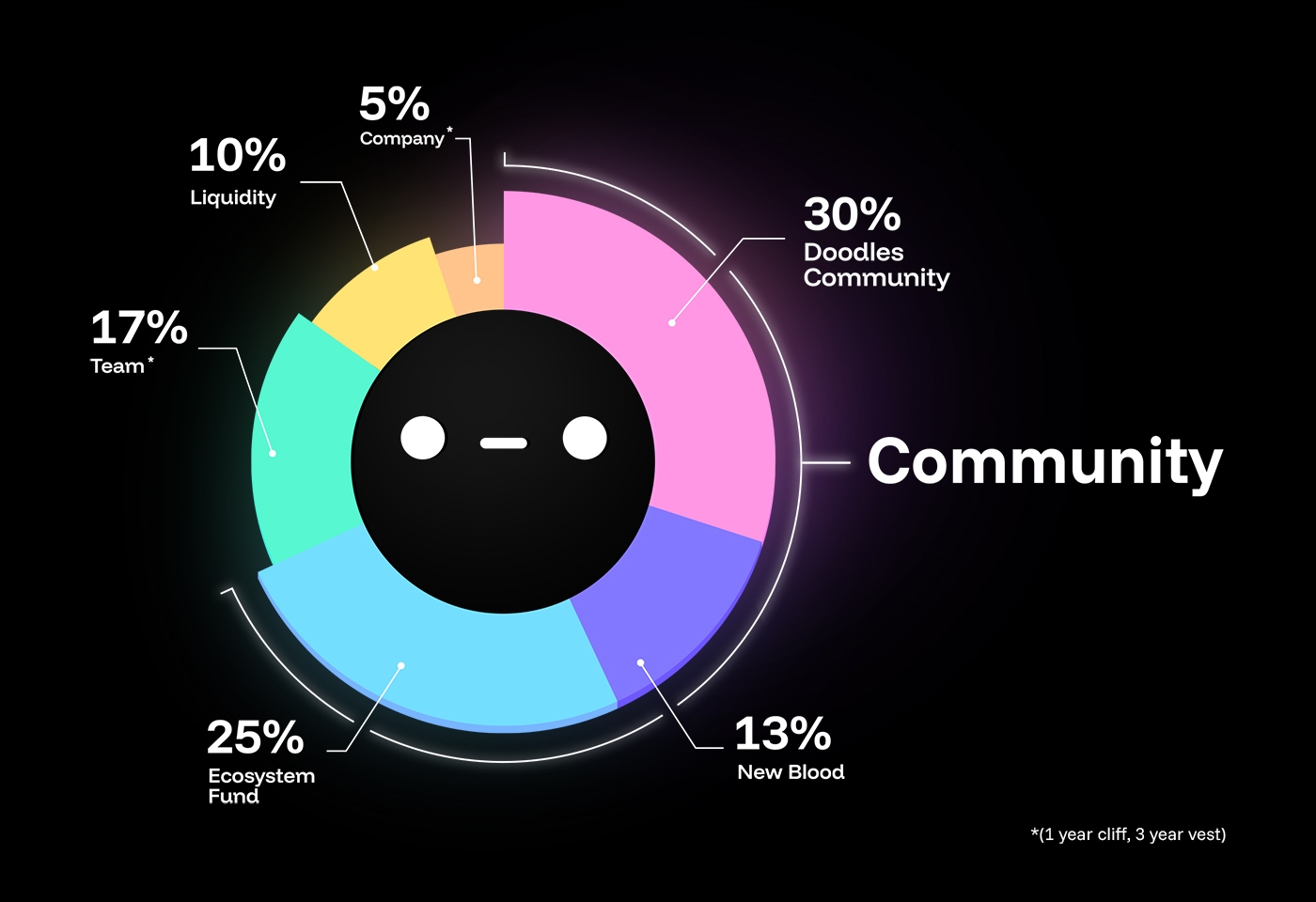

At the heart of Artemis Protocol governance NFTs lies a simple yet powerful mechanic. Buy an NFT, snag a senate seat with one vote, and tap into that 1% slice of trading fees in perpetuity. Proceeds from sales split neatly-33% to USTC burns, 33% treasury, 33% ecosystem funds-fueling growth while rewarding holders. CosmosEcosystem highlighted this on X, noting how it elevates NFT utility beyond collectibles.

Compare this to Lido’s model, where the DAO pockets about 5% of staking yields, or Uniswap’s governance debates over a 0.05% protocol fee on v3 pools. Artemis takes it further by tying fees directly to non-transferable badges, much like Otterspace’s approach to secure voting rights. No more sybil attacks or mercenary capital; these web3 voting badges trading fees demand skin in the game.

I’ve analyzed countless DAO setups over seven years, and this stands out. It mirrors veToken trends from protocols unifying around shared staking frameworks, as noted in Houlihan Lokey’s FinTech update. Holders aren’t just voting; they’re invested in fee-generating pools and proposals tweaking those very revenues.

Stake NFTs for DAO Voting: Beyond One-Time Rewards

“Each NFT you purchase will give you 1 vote on the DAO and will earn you 1% of all $ART trading fees in perpetuity. ” – LUNCArtemis on X

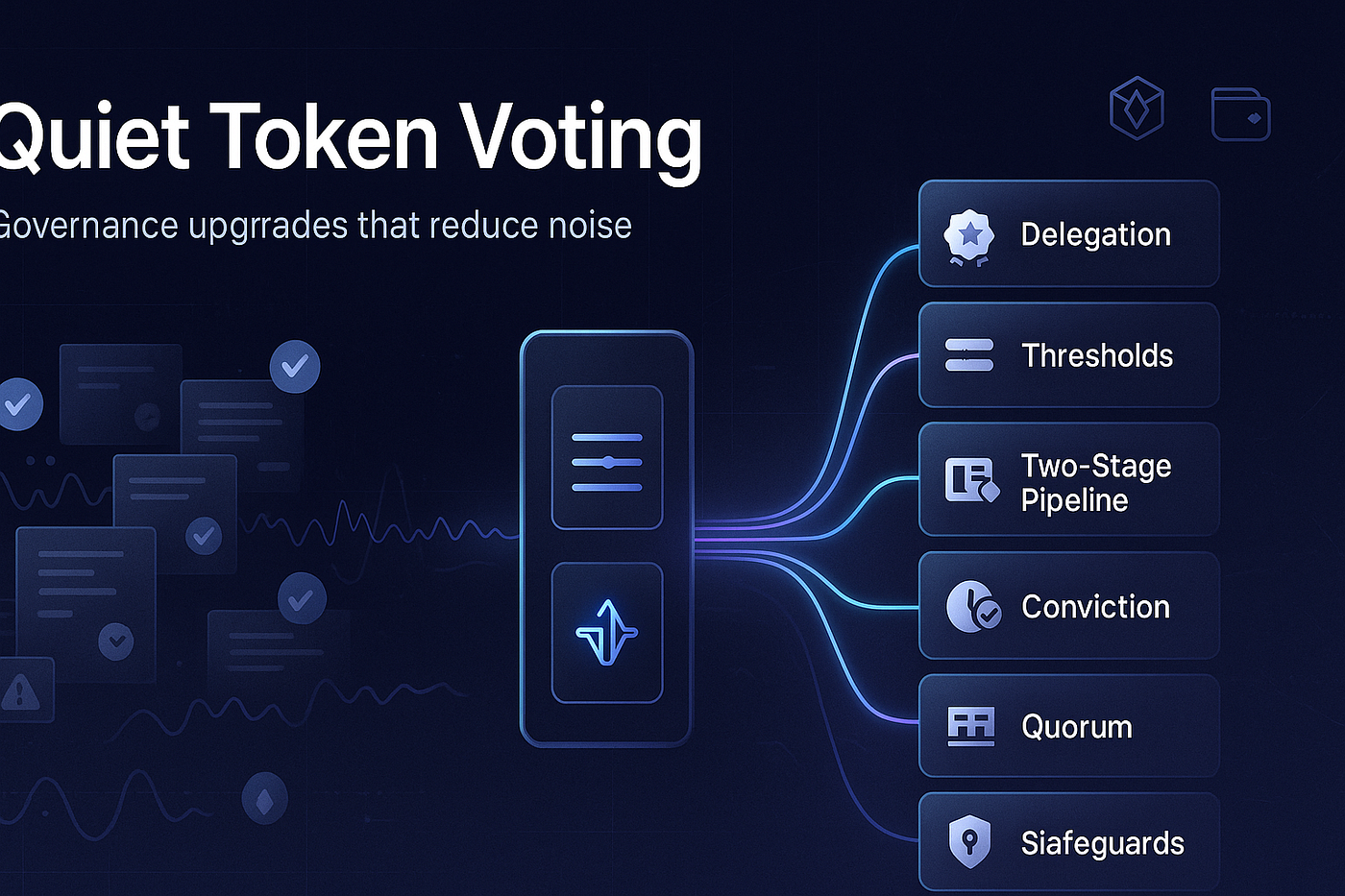

Stake NFTs for DAO voting flips the script on passive holding. In Artemis, your staked balance signals approve or reject on proposals-from fee adjustments to new pools-with a 4% quorum threshold. Ethereum’s staked value hovering near $40B all-time highs underscores the appeal; protocols capturing even slivers of that yield create treasuries that compound community loyalty.

Think practically: DAOs face governance fatigue. Generic tokens lead to whale dominance, but NFT badges tie rights to verifiable contributions. Platforms like Governance NFT Badges streamline issuance, verification, and display, making senate seats tamper-proof. Yet, as Astraea Counsel warns, launching these involves hefty compliance- $150K to $800K for securities analysis, docs, and risk assessments. Skip that, and you’re courting regulators.

Crafting Incentive-Aligned Senate Structures

To replicate Artemis in your DAO, start with badge design. Non-transferable NFTs ensure authenticity, preventing flips that undermine long-term alignment. Integrate fee-sharing smart contracts: route 20% of trading revenue to badge holders proportionally. Tools from Governance NFT Badges handle minting and soulbound logic seamlessly.

Opinion: This model’s opinionated edge lies in its unapologetic focus on earners. No universal basic voting; senate seats reward those driving volume. Uniswap’s RFC for temporary fees pales against Artemis’ forever streams. As stakers flock back-ETH at post-hard-fork highs-DAOs unifying on cross-protocol staking will dominate. Your next move? Prototype a senate with badges that pay dividends, not just lip service to decentralization.

Prototyping starts with smart contract audits and testnet deploys, but the real magic happens when badges integrate with your DEX or yield farm. Imagine routing fees automatically: every $ART trade credits your senate NFT, viewable on-chain via dashboards like Artemis Terminal. This isn’t theoretical; metrics show value accrual from staking participation outpacing one-off airdrops, as seen in Lido’s 5% DAO yield capture.

Comparison of DAO Revenue Models

| Protocol | Revenue Model | DAO/Participant Share | Details |

|---|---|---|---|

| Artemis Protocol | Perpetual NFT Trading Fees | 20% of total $ART trading fees | Each governance NFT badge earns 1% of trading fees in perpetuity; grants 1 DAO vote |

| Lido | Staking Yields | ~5% | DAO accrues ~5% of yields from staked ETH and other PoS tokens; users receive 90% |

| Uniswap | V3 Pool Fee (Proposed) | 0.05% | RFC to enable 0.05% protocol fee on all Uniswap v3 pools across chains for one month |

Such tables reveal why DAO senate NFTs edge out competitors. Artemis holders don’t wait for proposals; fees flow perpetually, sidestepping governance gridlock. Uniswap’s RFC for a one-month trial fee highlights the hesitation elsewhere, while Ethereum’s $40B staked value proves demand for locked-in rewards. Over my years tracking DeFi, I’ve seen protocols thrive when incentives align long-term, not quarterly.

Metrics That Matter: Fee Accrual in Action

Diving into Artemis Analytics, crypto revenue shines brightest in DAOs blending governance with yields. Stakers signal on fee tweaks or pool adds, needing just 4% quorum- far leaner than bloated token votes. This keeps decisions nimble, focused on growth. VanEck’s report on ETH’s hard fork rally reinforces it: even amid price dips, staked assets hit peaks because protocols like these deliver real returns.

This metric focuses on value accrual uniquely enabled by staking or actively participating in a protocol. Examples include staking/delegated staking on an L1.

Houlihan Lokey’s update nails the trend: veToken models and shared DAO tooling simplify this. Your senate badges become cross-protocol passports, stakeable across chains for compounded fees. Practical tip: pair with soulbound tech from Otterspace to thwart transfers, ensuring only true contributors hold sway.

Building Your Senate: Step-by-Step Wins

Steps to Launch Artemis-Style NFT Badges

-

Design non-transferable NFTs for votes and fees, like Otterspace badges—ensuring governance stays with true contributors, not flippers.

-

Deploy fee-sharing contracts routing 20% of trading fees to holders forever, just as Artemis Protocol shares 1% per NFT from total fees.

-

Set quorum at 4% staked supply for proposals on fees or pools, balancing efficiency with broad consensus like Artemis Finance.

-

Allocate NFT sales 33/33/33 to burns (e.g., USTC), treasury, and ecosystem—fueling growth and deflation as in Artemis.

-

Integrate verification via platforms like Governance NFT Badges or Otterspace to secure voting rights and privileges.

These steps cut through complexity, leveraging platforms tailored for web3 communities. Costs? Budget $150K-$800K for compliance, per Astraea Counsel- covering token docs and securities scrutiny. Skimp here, and your senate crumbles under legal heat. But done right, it fosters transparency: every vote verifiable, every fee auditable.

Opinionated take: Ditch egalitarian illusions. Stake NFTs for DAO voting rewards volume drivers, mirroring real senates where influence earns perks. Artemis proves it scales; LUNCArtemis’ “Welcome to the Senate” minted engaged holders earning indefinitely. As DAOs unify tooling, expect senate badges standardizing web3 voting badges trading fees.

Secure your edge today. Issue badges that bind votes to value, turning participants into proprietors. Governance NFT Badges equips you with the toolkit- from minting to management- empowering DAOs to govern like never before. Stake, vote, earn: the senate awaits.

Explore DAO badge issuance or dive into management best practices to kickstart yours.