Decentralized Autonomous Organizations on Solana boast cutting-edge infrastructure, yet their governance processes often mirror the apathy of local elections, with voter turnout languishing below 5% in many cases. As Binance-Peg SOL trades at $88.94, up $1.79 over the last 24 hours, the blockchain’s ecosystem hums with activity from DeFi protocols to meme coins. But when it comes to DAOs deciding on treasury allocations or protocol upgrades, participation plummets. This disconnect threatens the very foundation of decentralized decision-making, where governance NFT badges emerge as a pragmatic fix for DAO voter turnout on Solana.

Unpacking the Turnout Crisis in Solana DAOs

Reports like BlockEden’s analysis highlight a stark reality: despite industrial-grade tools, average DAO turnout rivals or underperforms municipal ballots. Token-weighted voting, the default in most setups, amplifies this issue. Whales with outsized holdings dominate, while small holders feel their votes drowned out, leading to abstention. Helius’s comprehensive review of Solana governance traces this evolution, noting how proposal mechanisms and off-chain signaling via Snapshot, covering 95% of DAOs per ResearchGate studies, fail to convert awareness into action.

Sources from Medium’s Gaudiy Lab to Hashnode’s engagement guide pinpoint low voter turnout as a core impediment, stalling progress and inviting centralization risks. MoonPay echoes this, calling it a serious on-chain governance flaw. Even innovative models like futarchy, praised by Bankless, acknowledge traditional voting’s pitfalls: low participation, whale sway, and myopia. On Solana, where speed and low fees should encourage engagement, dynamic tools from Solana Compass tie voting to token balances or NFTs, yet adoption lags.

Key DAO Governance Challenges

-

Token-weighted dominance stifles small holders, as large ‘whale’ holders control outcomes, per Helius Solana analysis.

-

Sybil attacks undermine legitimacy by allowing fake identities to manipulate votes, a core DAO vulnerability.

-

Lack of incentives breeds apathy, with turnout lower than local elections (BlockEden.xyz).

-

Whale short-termism overrides long-term value, favoring quick gains over sustainable growth (Bankless).

Governance NFT Badges as Contribution-Based Antidote

Soulbound governance NFT badges flip the script by anchoring voting power to verifiable contributions rather than liquid tokens. Non-transferable by design, these badges link to wallets via platforms like Dork. fi and WarpSynk, rewarding code commits, forum posts, or event attendance. A ‘Senior Contributor’ badge might grant 3x voting weight, aligning influence with impact. This mitigates Sybil attacks, one unique participant, one credential, and gamifies governance, turning passive holders into active stewards.

Unlike fleeting airdrops, which Gaudiy Lab notes boost turnout temporarily, NFT badges build lasting reputation. Rapid Innovation’s tokenomics guide nods to governance tokens’ role, but NFTs extend this to immutable proof-of-engagement. Oodles Blockchain emphasizes how token distribution shapes power; badges democratize it further. For Solana DAOs, this means issuing badges that enhance transparency without diluting speed.

Implementing Solana DAO Governance NFTs for Real Impact

Picture a Solana DAO treasury vote: traditional token holders barely muster quorum, but with Solana DAO governance NFTs, badge holders, proven contributors, drive quorum effortlessly. WarpSynk’s integration allows dynamic weighting, where badges stack for prestige levels. This boosts DAO participation with NFTs, addressing whale dominance head-on. As SOL holds steady at $88.94 amid a 24-hour high of $91.08, DAOs leveraging these tools position for sustained growth.

Early adopters report turnout jumps, per governancenft. com insights, as badges foster community pride. No more ‘vote and dump’; instead, sustained involvement yields escalating privileges. This pragmatic shift, rooted in Solana’s NFT ecosystem, sidesteps token inflation while rewarding merit. For portfolio managers like myself, integrating such DAOs means betting on resilient governance, bridging TradFi discipline with web3 innovation.

Details on setup via Dork. fi reveal a streamlined minting process: define criteria, automate issuance, verify on-chain. This not only fixes turnout but elevates decision quality, as engaged voters prioritize long-term value over pumps.

To harness this potential, Solana DAOs must prioritize accessible tools that lower barriers to badge issuance. Platforms streamline the process, ensuring even non-technical treasurers can deploy soulbound credentials without custom smart contracts.

Once deployed, these governance NFT badges integrate seamlessly with voting protocols like Realms or Squads on Solana. Badge holders gain tiered access: basic participants earn entry-level badges for forum activity, while core developers unlock advanced ones via GitHub proofs. This layered system, as seen in dynamic voting from Solana Compass tools, ties power to sustained effort, fostering a meritocracy that token snapshots alone can’t achieve.

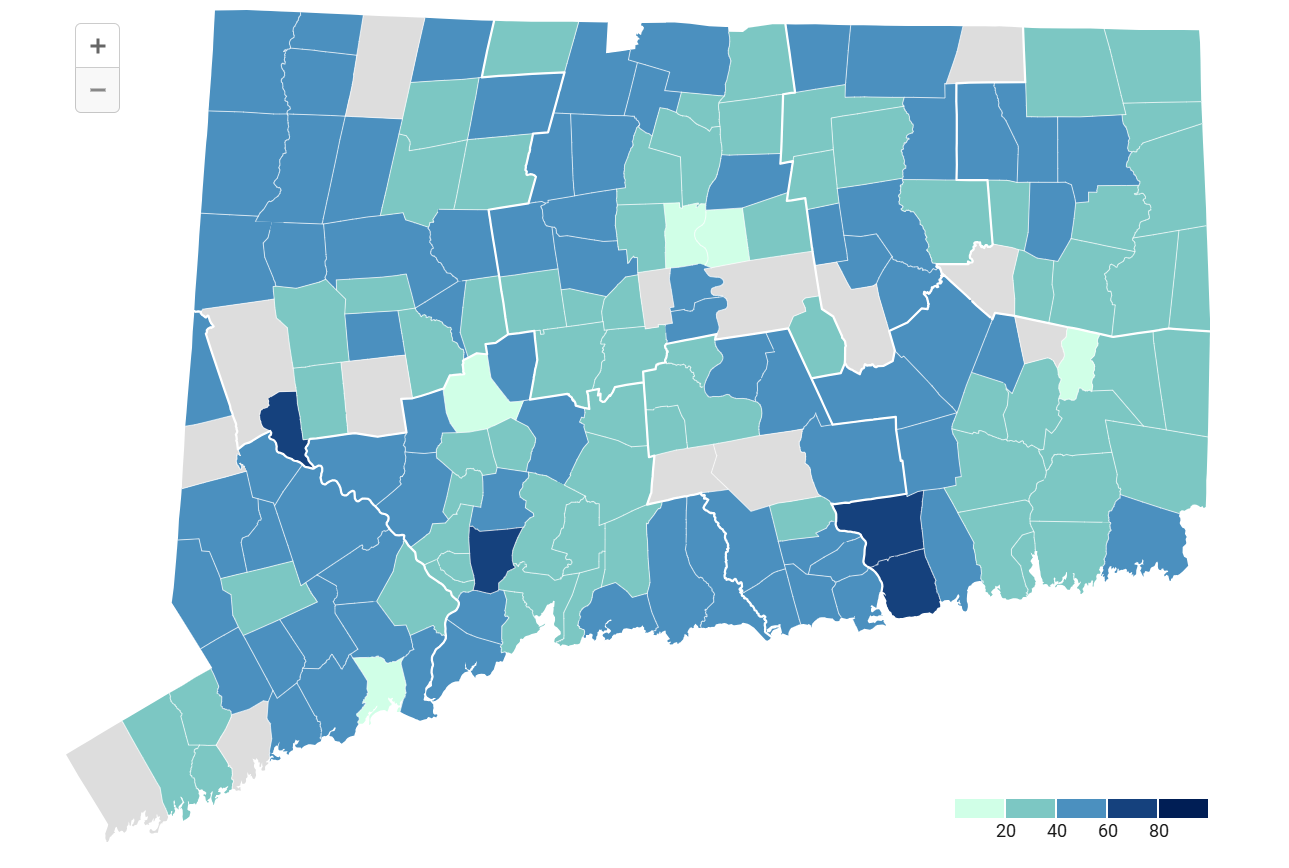

Consider the data: empirical studies on Snapshot reveal that 95% of DAOs grapple with engagement metrics mirroring the low turnout crisis. Yet, projects experimenting with NFT voting rewards in DAOs report 5x-10x participation lifts. Badges counter whale dominance by capping influence per wallet, regardless of SOL stack, while encouraging broad involvement. In a market where Binance-Peg SOL sits at $88.94 after touching a 24-hour high of $91.08, such mechanisms stabilize DAOs against volatility-driven apathy.

Critics might argue badges introduce centralization via issuer discretion, but on-chain automation and multisig treasuries mitigate this. Solana’s sub-second finality ensures tamper-proof issuance, outpacing Ethereum’s gas wars. Compared to Oodles Blockchain’s token models, NFTs add verifiability, turning governance into a prestige economy.

As DAOs leverage NFT badges to boost participation, expect cascading effects: sharper proposals, faster iterations, and treasury efficiency. Platforms like Governance NFT Badges simplify this, offering templates for Solana-specific setups. The result? Communities where every voice, backed by badges, propels collective value.

With SOL’s ecosystem maturing at $88.94, now’s the moment for DAOs to badge up. This shift doesn’t just fix turnout; it builds antifragile organizations, primed for web3’s next phase. Portfolio managers take note: governance innovation like Solana DAO governance NFTs separates enduring projects from flash-in-the-pan tokens.