In the evolving landscape of DAO governance, the relationship between NFT rarity, staking mechanisms, and voting power is reshaping how influence is distributed within decentralized communities. As DAOs mature, these models are not just technical experiments but strategic levers that determine who shapes protocol direction and how equitably decisions are made. Understanding how rarity and staking intersect with governance NFT badges is essential for any participant seeking real agency in a decentralized organization.

Why Rarity Matters: The Mechanics Behind NFT-Based Voting Rights

At its core, NFT rarity refers to how unique or scarce a particular token is within a collection. In DAO governance, this scarcity can translate directly into voting influence. For example, projects like LegacyLink DAO explicitly assign greater voting weight to rarer NFTs, meaning a member holding an ultra-rare badge wields more say over treasury allocation or protocol upgrades than someone with a common token. This meritocratic approach incentivizes early adoption and rewards those who acquire or contribute to the most sought-after assets.

However, not all DAOs embrace this model. Some communities, such as Polychain Monsters DAO, opt for a more egalitarian structure where each NFT, regardless of its rarity, grants exactly one vote. This approach is designed to foster whale resistance and ensure that governance isn’t dominated by a handful of rare-NFT holders. The trade-off? Potentially less incentive for collectors to pursue rare tokens unless other utility or recognition is attached.

The Role of Staking: From Passive Holding to Active Influence

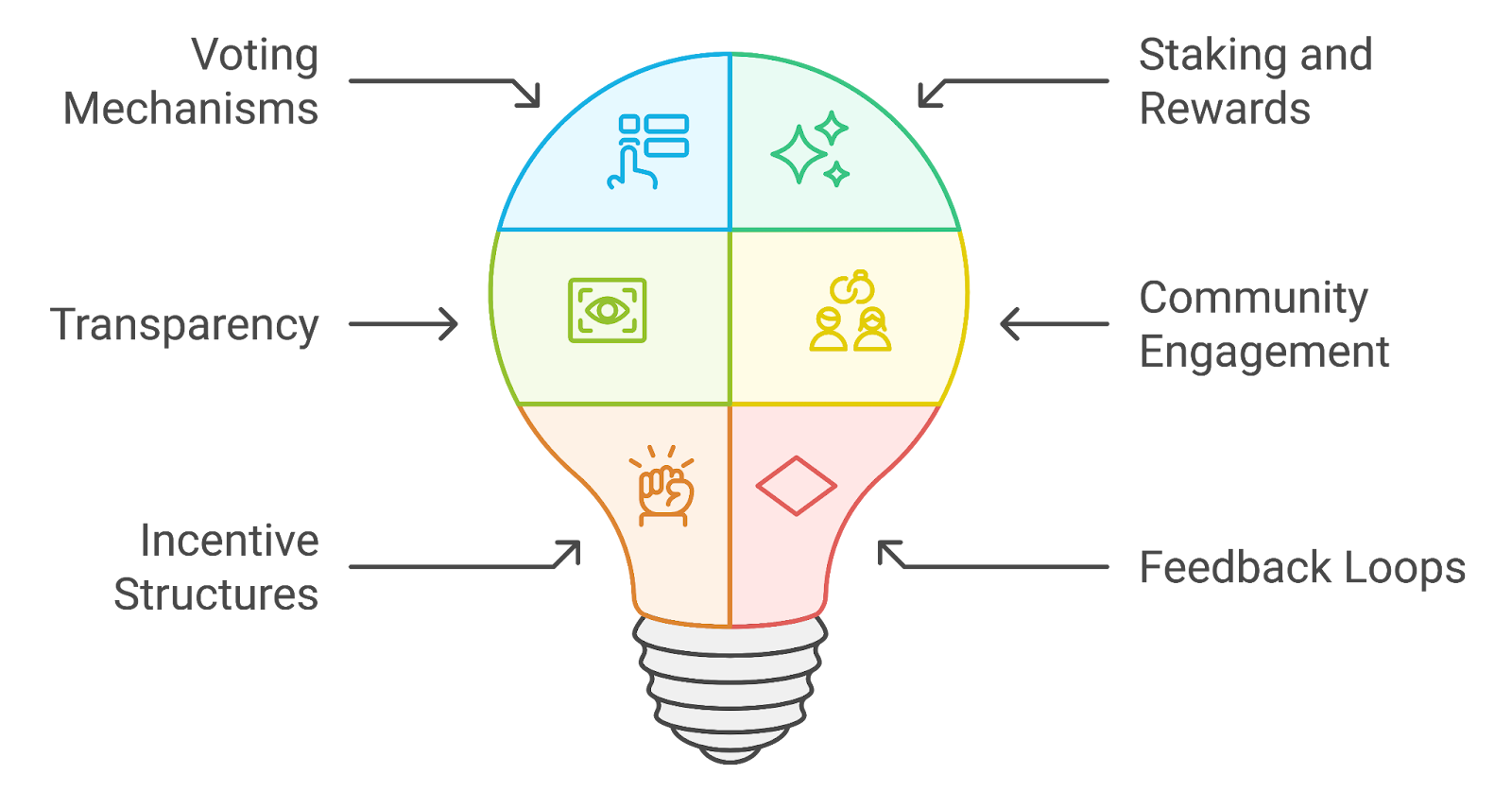

NFT staking introduces another layer of nuance to DAO governance. By locking up NFTs for a set period (sometimes called “soft staking” when tokens remain in your wallet but are committed via smart contract), members can unlock enhanced voting rights or bonus rewards. In platforms like Stake DAO, both the dollar value staked and the rarity of NFTs held determine bonus multipliers, meaning your influence grows not just by owning rare NFTs but by actively participating in the ecosystem’s financial activities (source).

This dynamic encourages long-term engagement rather than speculative flipping, a critical factor in building resilient governance structures over time. Yet some DAOs deliberately decouple staking from voting rights (as seen in SuperVerse DAO) to avoid imbalances where wealthy participants could accumulate outsized control simply through capital deployment (source). Striking the right balance between rewarding commitment and maintaining fair representation is an ongoing challenge across the sector.

Rarity-Based vs Equal-Vote NFT Governance: Pros & Cons

-

Rarity-Based Voting: Enhanced Influence for Rare NFT HoldersDAOs like Stake DAO and LegacyLink DAO assign greater voting power to holders of rare NFTs. This approach rewards collectors and early adopters, incentivizes participation, and can drive up the value of rare NFTs. However, it may foster centralization, as a few members with rare assets can dominate governance decisions.

-

Rarity-Based Voting: Potential for Governance ImbalanceWhile rarity-based models can boost engagement, they risk creating barriers to entry for new or less wealthy participants. This can lead to governance captured by a small group, reducing the diversity of perspectives and potentially undermining the DAO’s legitimacy.

-

Equal-Vote Models: Promoting Fairness and AccessibilityPlatforms like Polychain Monsters DAO use equal-vote models, where each NFT grants the same voting power regardless of rarity. This ensures a level playing field, encourages broad participation, and prevents wealth or rarity concentration from skewing decisions.

-

Equal-Vote Models: Limited Incentives for Rarity and EngagementWhile egalitarian, equal-vote systems may lack the incentives that rarity-based models provide for collecting, holding, and engaging with NFTs. This can reduce the perceived value of rare NFTs and may not fully leverage the potential for gamified engagement.

-

Staking Integration: Rewarding Active ParticipationSome DAOs, such as Crypto Unicorns, allow NFT staking to boost voting power. This approach rewards active members and long-term holders, but if not carefully managed, can introduce complexity and further centralize power among those with more resources to stake.

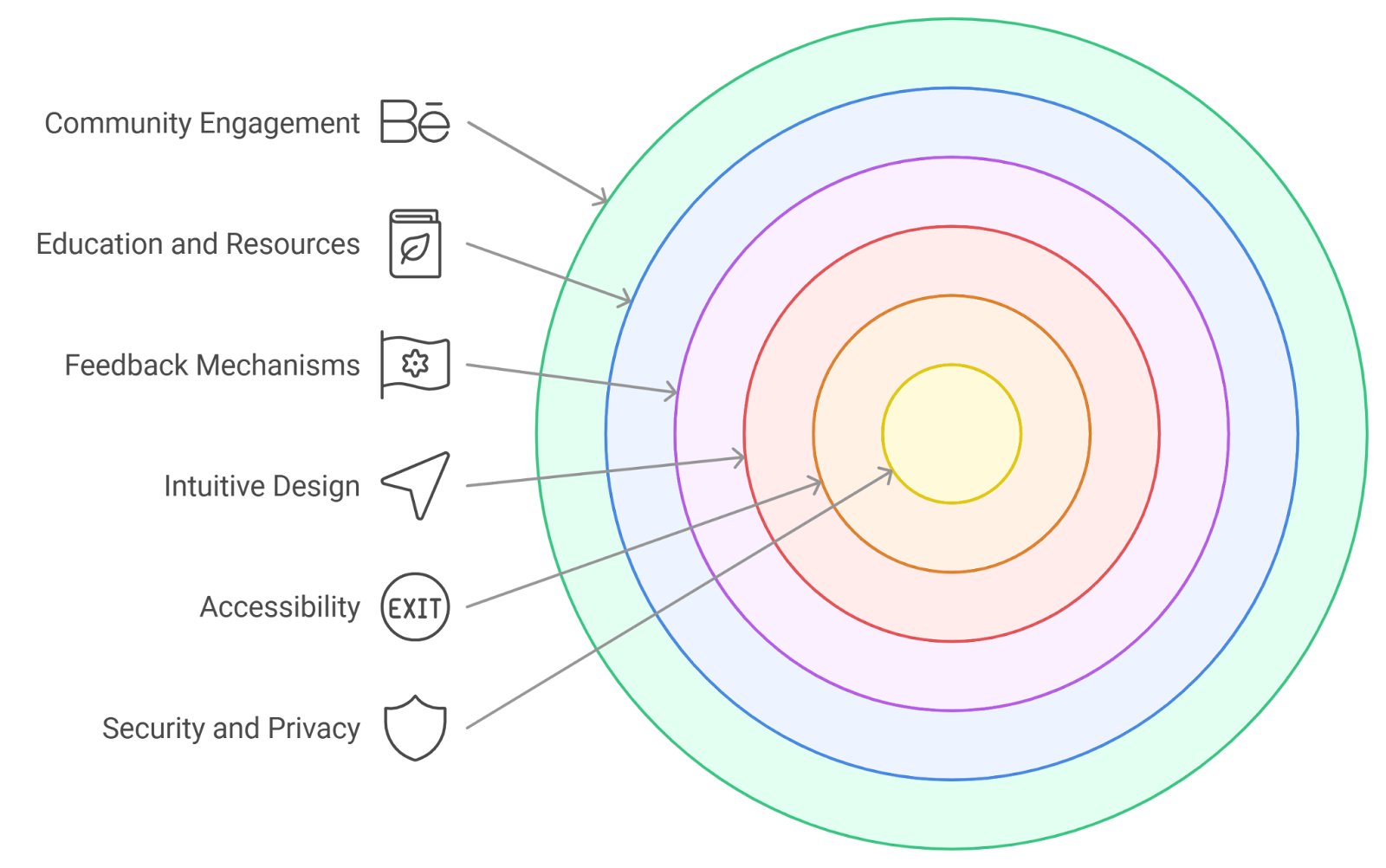

Reputation-Based Governance Badges: Toward Meritocratic Influence

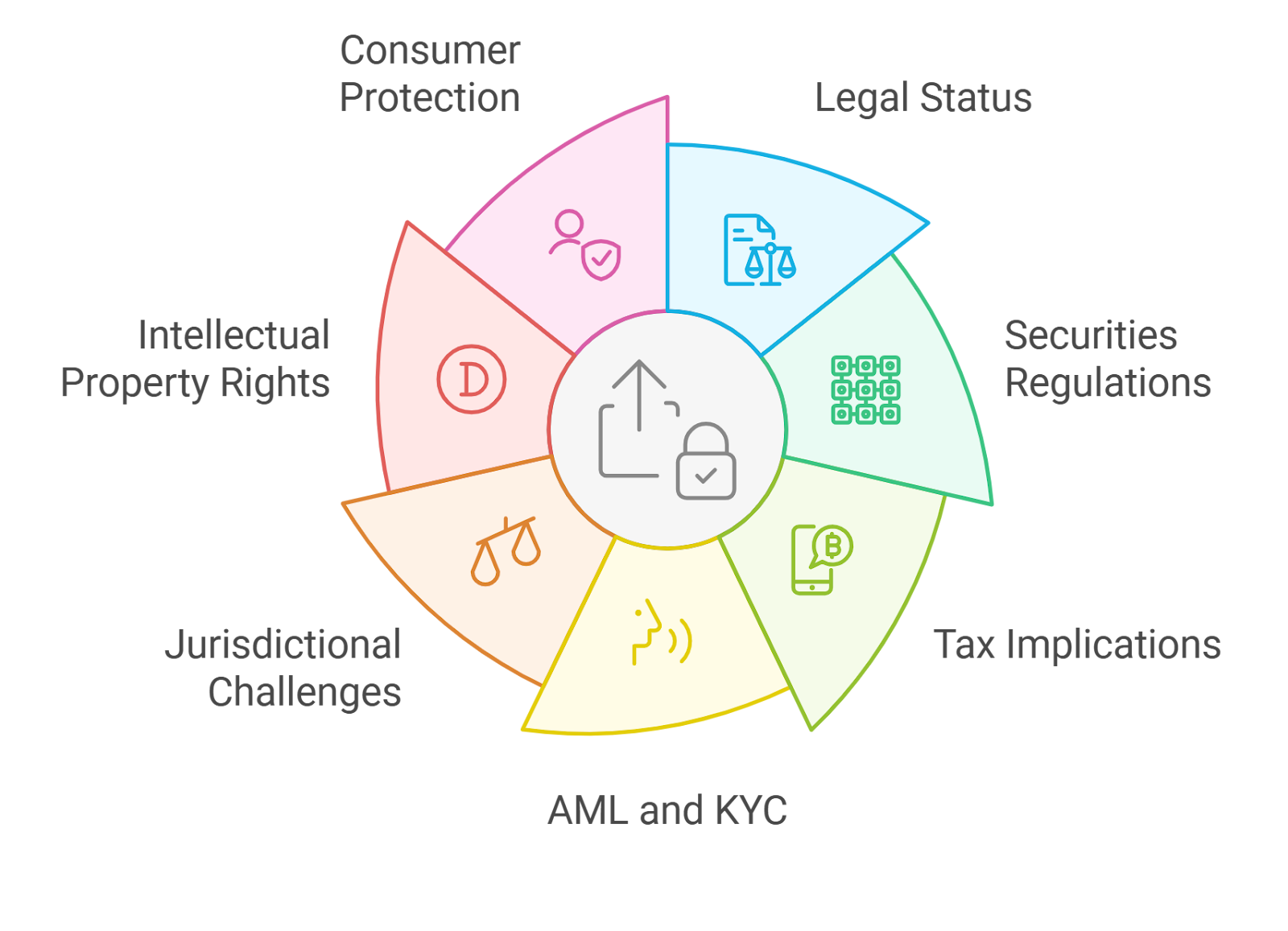

The latest wave of governance innovation leverages reputation-based NFTs, where voting power is earned through meaningful contributions rather than mere asset ownership. Platforms like Governance NFT Badges enable DAOs to issue verifiable credentials tied to on-chain activity, forum participation, or successful proposal authorship (source). This model aligns incentives more closely with community health, those who build value gain more say over future direction.

Still, reputation systems must be designed with care; overemphasis on past actions can ossify leadership structures or discourage new voices from emerging. The practical takeaway for DAO members? Always review your community’s constitution or governance docs before investing in rare NFTs or committing assets to staking pools, the rules governing influence vary widely across protocols.

Strategically, the interplay between NFT rarity, staking, and governance badge reputation is shaping a new calculus for influence in decentralized organizations. When evaluating where to direct your time and assets, it’s vital to weigh the long-term impact of these mechanisms on both your own agency and the health of the DAO.

Practical Steps: Navigating DAO Governance with NFT Rarity and Staking

For those seeking to maximize their role in DAO governance, here’s a pragmatic approach:

How to Evaluate DAO Governance: NFT Rarity, Staking, and Reputation

-

Review the DAO’s Governance Documentation: Start by examining the DAO’s constitution, whitepaper, or governance portal to understand how NFT rarity, staking, and reputation factor into voting power. For example, Stake DAO clearly outlines how NFT rarity and staking affect member influence.

-

Identify How NFT Rarity Impacts Voting Rights: Determine whether the DAO uses a rarity-weighted or egalitarian approach. In Stake DAO, rarer NFTs increase voting power, while in Polychain Monsters DAO, each NFT—regardless of rarity—confers one vote.

-

Assess Staking Mechanisms and Their Influence: Check if staking NFTs boosts governance privileges. In Crypto Unicorns, staking NFT badges increases voting power. Conversely, SuperVerse DAO separates staking from voting, using a one-token-one-vote model.

-

Analyze Reputation-Based Voting Models: Explore whether the DAO incorporates reputation systems—where voting influence grows with member contributions and engagement. Platforms like GovernanceNFT highlight meritocratic models that reward active participation.

-

Participate and Monitor Governance Changes: Engage in DAO forums and proposal discussions to stay updated on evolving rules around NFT rarity, staking, and reputation. Active involvement ensures you can adapt to governance shifts and maximize your influence.

First, analyze the governance framework. Is voting power strictly tied to NFT rarity? Does soft staking boost your weight in proposals? Or does the DAO employ a one-NFT-one-vote model to curb whale dominance? These distinctions determine whether accumulating rare NFTs or engaging in long-term staking aligns with your goals.

Second, assess risk versus reward. In DAOs where rare NFTs grant greater voting power, early entrants or those willing to pay a premium can shape protocol evolution. However, this can also create barriers for new members and raise centralization risks if left unchecked. Conversely, egalitarian models may foster broader participation but lack incentive for sustained investment unless paired with reputation-based rewards.

Third, monitor evolving dynamics. Governance rules change as DAOs mature. For example, some projects initially favor rarity-based systems but later pivot toward meritocratic or hybrid models as community needs shift. Staying active in discussions and proposal reviews ensures you’re not blindsided by changes that affect your influence.

Looking Ahead: Balancing Power and Participation

The future of NFT-based voting rights will likely blend elements of rarity, staking commitment, and on-chain reputation. DAOs experimenting with dynamic weighting, where rare NFTs offer baseline power but additional influence accrues through active participation, are setting new standards for resilient governance. This mitigates the risk of ossified leadership while still rewarding meaningful engagement.

The core challenge remains: how do you ensure that those most invested, whether through capital or contribution, have appropriate say without undermining inclusivity? There’s no universal answer yet. The most robust DAOs are transparent about their models and regularly revisit them as their communities evolve.

“Ultimately, sustainable decentralized governance depends not just on clever smart contracts but on clear rules that balance meritocracy with broad access. ”

Key Takeaways for DAO Members

- Review governance docs: Don’t assume all DAOs treat NFT rarity or staking equally, read the fine print before investing.

- Diversify your engagement: Combine holding rare NFTs with active participation to maximize both direct voting power and reputation-based influence.

- Stay adaptable: As protocols update their frameworks, reevaluate your strategy regularly.

- Pursue transparency: Favor DAOs that clearly communicate how voting rights are allocated, and participate in discussions about potential reforms.

The landscape is evolving rapidly. By understanding how governance NFT badges, rarity tiers, soft staking mechanics, and reputation signals interact within each protocol’s constitution, you’ll be better equipped to claim meaningful agency, and help shape fairer decentralized futures.