In the evolving landscape of decentralized autonomous organizations, onchain governance reputation NFTs are emerging as a cornerstone for recognizing DAO contributors. These immutable governance credentials provide a tamper-proof record of participation, transforming abstract contributions into verifiable assets on the blockchain. As DAOs manage $21.4 billion in liquid assets in 2025, yet grapple with just 17% average voter turnout, these governance NFT badges offer a practical solution to boost engagement without relying solely on token holdings.

Picture a contributor who consistently proposes ideas, votes diligently, and mentors newcomers. Traditionally, such efforts might fade into forum threads or Discord chats. Now, with platforms like Governance NFT Badges, those actions mint as non-transferable onchain reputation NFTs, building a public portfolio anyone can inspect. This shift aligns incentives, rewarding merit over mere speculation.

Proof of Participation Builds Lasting DAO Ecosystems

DAOs issue these DAO voting badges for tangible actions: attending town halls, completing bounties, or hitting proposal thresholds. Each badge serves as an on-chain attestation, stacking over time to form a reputation profile. For instance, governancenft. com highlights how such systems create transparent records, enabling communities to allocate grants or roles based on proven track records rather than self-reported claims.

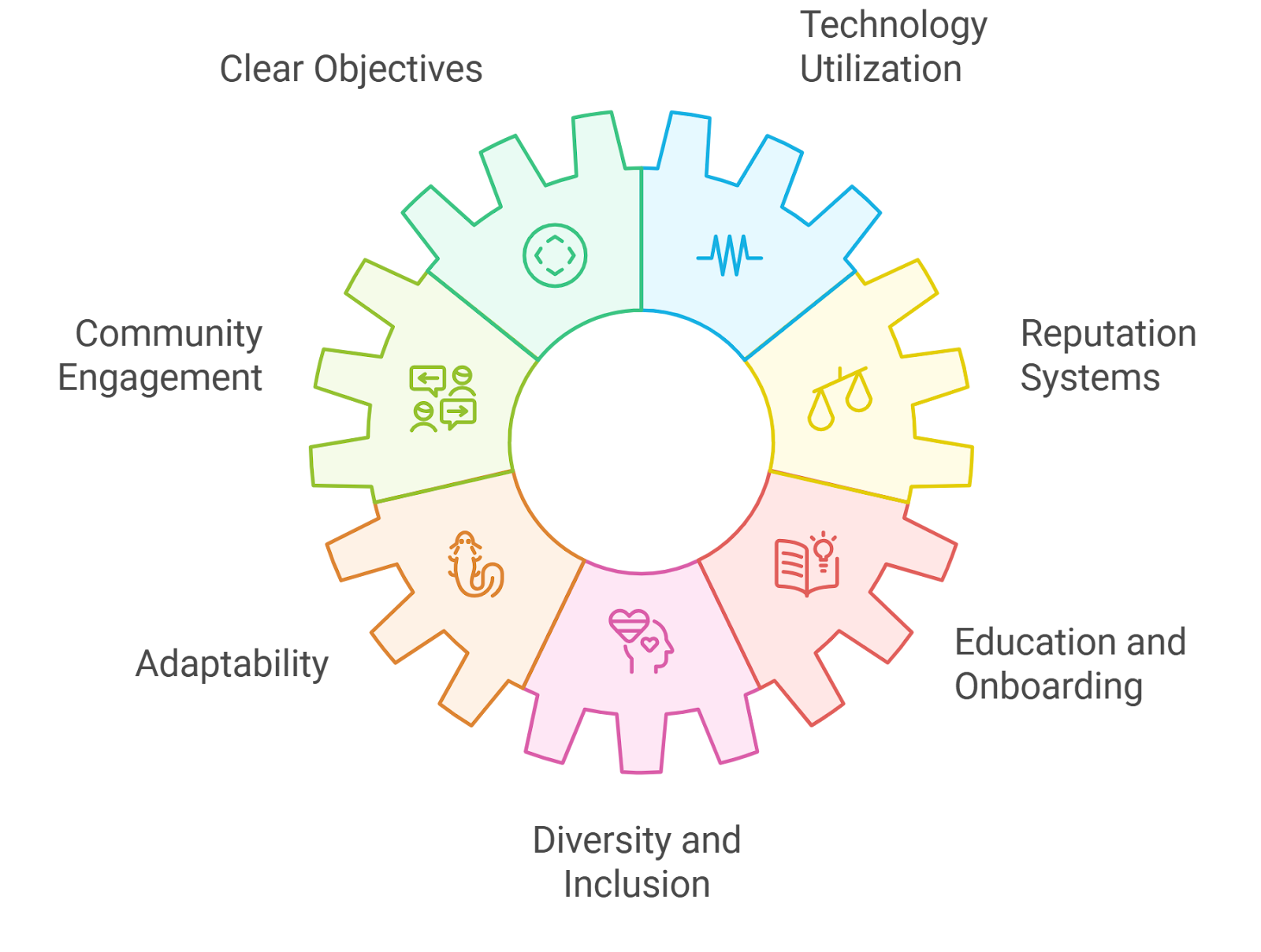

Key Benefits of Reputation NFTs

-

Immutability: Onchain reputation NFTs are permanent and non-alterable once minted, providing enduring proof of contributions as seen in platforms like Governance NFT.

-

Sybil Resistance: These NFTs help DAOs distinguish genuine contributors from sybil attackers using identity-linked systems, similar to Gitcoin Passport.

-

Incentive Alignment: Badges reward participation in tasks, voting, and events, fostering engagement with perks like token distributions via tools like DAOBadgeX.

-

Verifiable History: NFTs create transparent, onchain portfolios of achievements, easily checked for meetings, votes, and projects on platforms like Snapshot.

-

Merit-Based Access: Voting power and roles are granted based on proven contributions, promoting equitable governance over token holdings alone.

This mechanism counters sybil attacks, a persistent threat where fake identities dilute governance. Tools like Gitcoin Passport inspire these systems, linking identities to contributions. Ethereum, powering many DAOs at its current price of $2,757.8, provides the secure ledger; its intraday range from $2,722.99 to $3,033.52 underscores the network’s resilience amid volatility.

Voting Power Tied to Verifiable Contributions

Integrating web3 DAO contributor badges with voting tools like Snapshot revolutionizes decision-making. Instead of one token equals one vote, power scales with badges earned, ensuring legitimacy. A member with badges for sustained participation casts ballots weighted by merit, deterring manipulation and fostering trust. This model echoes fundamental analysis in markets: assess underlying value before committing capital.

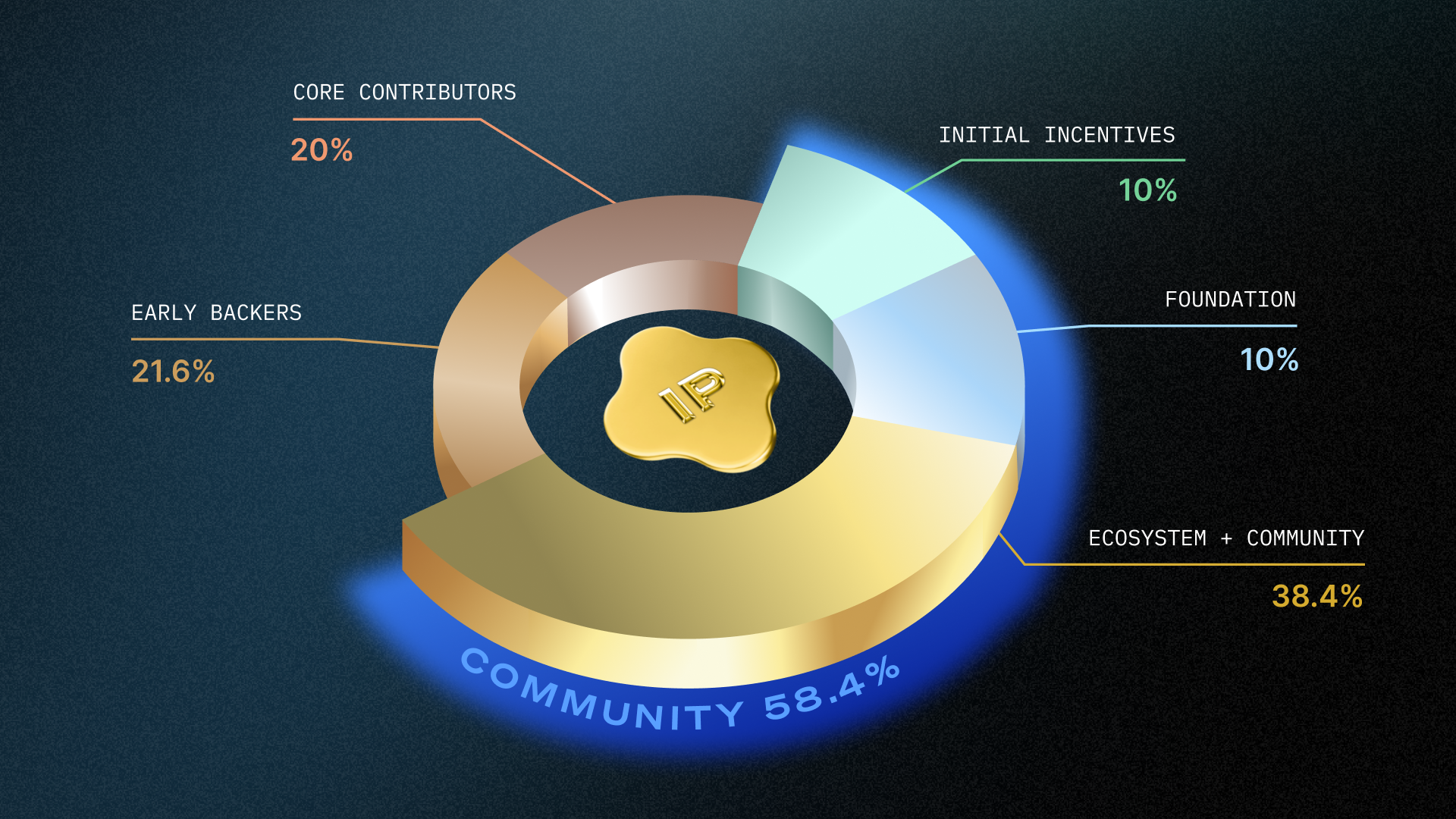

DAOs collectively manage approximately $21.4 billion in liquid assets, yet voter participation averages only 17%.

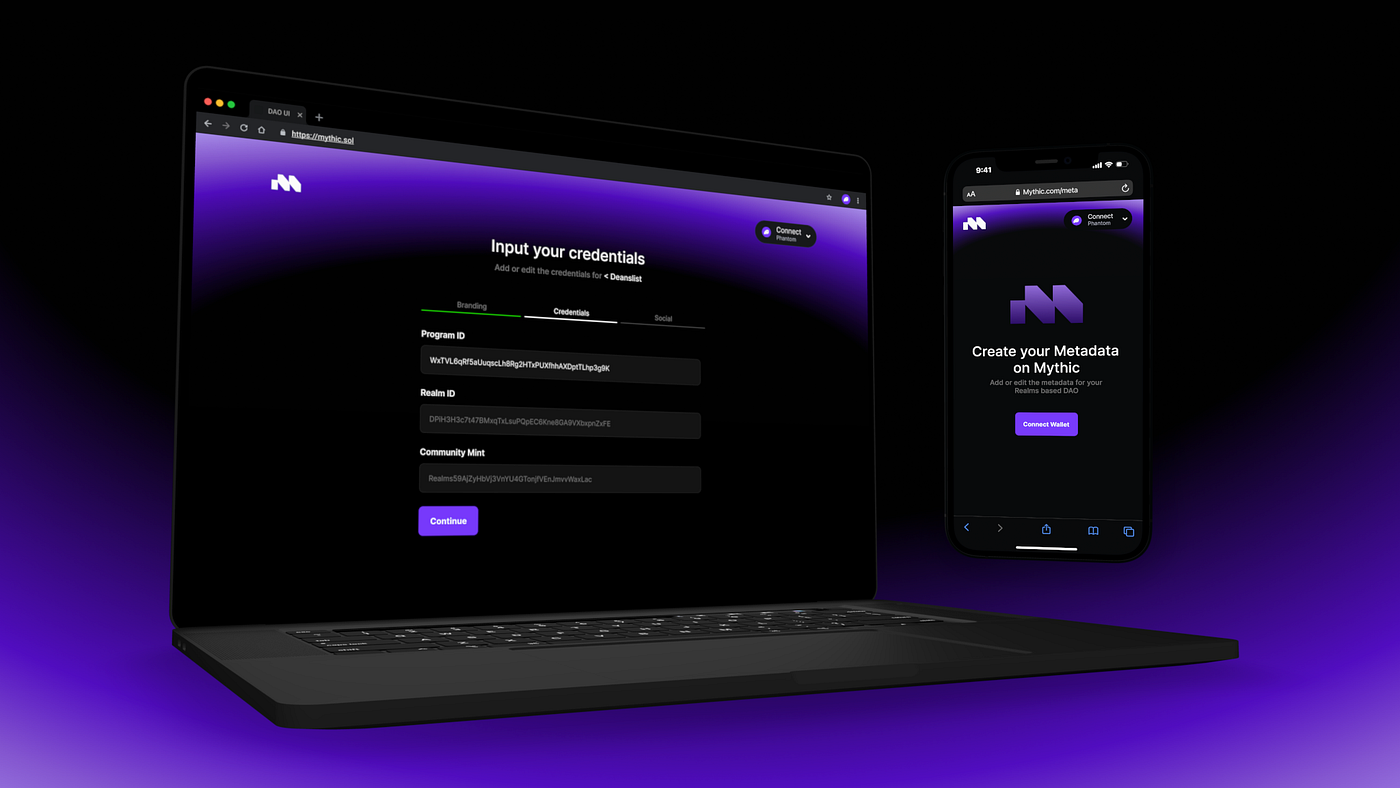

Consider DAOBadgeX, a dynamic NFT that evolves with user activity, as noted in DAOBase discussions. It automates reputation accrual, making governance more equitable. By referencing badges, DAOs sidestep concentrated power in whale wallets, distributing influence to active builders.

Real-world examples abound: Realms on Jito Network uses similar credentials for ecosystem DAOs like BonkDAO and Pyth Network. These badges not only verify votes but unlock perks, from token airdrops to exclusive forums, creating a flywheel of engagement.

Incentivizing Depth Over Superficial Activity

Beyond binary participation, onchain reputation NFTs reward quality. Badges for mentoring or project delivery carry higher weight, calibrated via community governance. This nuanced approach addresses low turnout by making contributions feel immediate and rewarding. As Ethereum holds steady at $2,757.8 after a -0.09% dip, its stability bolsters confidence in these on-chain primitives.

Challenges persist, like badge fatigue or centralization in issuance protocols. Yet, solutions emerge: soulbound tokens ensure non-transferability, while modular designs allow DAOs to customize criteria. In essence, these NFTs ground DAO governance in verifiable reality, much like commodities markets rely on physical delivery assurances.

Soulbound tokens, pioneered by Vitalik Buterin, exemplify this non-transferable design, anchoring reputation to wallets without resale temptation. Modular protocols let DAOs tweak badge criteria via on-chain votes, adapting to evolving needs without hardcoded rigidity. This flexibility mirrors risk management in forex: position sizing based on volatility, not blind leverage.

Case Studies: DAOs Leading with Reputation NFTs

Realms on Jito Network stands out, powering badges for high-profile DAOs like BonkDAO, Metaplex DAO, and Pyth Network. Contributors earn DAO voting badges for ecosystem tasks, from liquidity provision to proposal advocacy. These badges unlock quadratic voting or treasury access, directly tying reputation to impact. Similarly, DAOBadgeX deploys dynamic NFTs that upgrade automatically; complete a milestone, and your badge levels up, visible across Web3 profiles.

Real DAOs Using Governance NFT Badges

-

Realms (Jito Network): Powers multi-DAO coordination on Solana for projects like Jito, BonkDAO, and Metaplex DAO, using governance NFTs for verifiable contributor roles and voting.

-

DAOBadgeX: Dynamic on-chain reputation NFT that auto-evolves based on governance participation, tailored for Web3 DAOs to track and reward contributions.

-

Gitcoin Passport: Enables sybil-proof voting in DAOs via identity-linked reputation badges, distinguishing genuine contributors from attackers.

Such systems extend beyond Solana to Ethereum, where layer-2 scaling keeps gas fees manageable. At $2,757.8, Ethereum’s price reflects network strength, dipping just -0.09% amid broader market chop, with intraday lows at $2,722.99 testing support levels. DAOs on ETH benefit from this stability, minting badges without prohibitive costs.

NFT-driven governance, as Delphi Digital outlines, swaps fungible tokens for 1 NFT = 1 vote models. This prevents whale dominance, weighting voices by badges rather than bags. GamesPad notes identity-linked reps thwart sybils, much like KYC in traditional finance verifies legitimacy before capital flows.

Technical and Economic Considerations

Implementing immutable governance credentials demands smart contract audits and oracle feeds for off-chain verification. Platforms like Governance NFT Badges simplify this, offering no-code issuance tied to multisig approvals. Economically, badges create flywheels: higher reps yield better grants, spurring more activity and treasury growth. With DAOs holding $21.4 billion, even a 5% participation bump via badges could unlock millions in productive capital.

Yet opinion divides on centralization risks. If issuance concentrates in few hands, badges mimic old hierarchies. Counter this with timelocks and delegation revokes, ensuring badges sunset if contributions lapse. My take, drawn from macro cycles: treat reputation like a commodity curve; overaccumulation signals froth, prompting rebalancing votes.

Layered with AI, as 0g AI hints, badges could auto-assess contributions via decentralized oracles. Imagine bots scoring code commits or sentiment in forums, minting badges permissionlessly. This scales meritocracy, but demands robust dispute mechanisms to avoid oracle failures.

Charting the Path Forward

By 2026, expect onchain reputation NFTs as standard DAO infrastructure, integrated with wallets like Rabby or social graphs on Farcaster. Cross-DAO badge portability will emerge, letting a Uniswap contributor shine in Aave governance. This interoperability fosters a unified Web3 labor market, where reps compound across protocols.

Challenges like badge inflation loom; solve via decay mechanics, where dormant reps fade. Ethereum’s resilience at $2,757.8 underpins this vision, its -0.09% shift a mere blip against proof-of-stake efficiency. DAOs evolve from token casinos to contributor cooperatives, badges as the immutable ledger of merit.

Active builders now hold the edge. Stack those badges, verify your grind on-chain, and watch governance bend toward value creators. In decentralized realms, reputation isn’t whispered; it’s etched in stone.