In the rapidly evolving Web3 ecosystem, tradable governance NFT badges are redefining how Decentralized Autonomous Organizations (DAOs) distribute voting power and influence. By moving beyond fungible tokens and static reputation scores, these dynamic digital credentials introduce a transparent, merit-based system that rewards real contributions while enabling flexible participation models. The result? A new era of DAO governance where influence is both verifiable and, in many cases, tradable.

From Token Holdings to Tokenized Merit: The Rise of Governance Badges

The traditional DAO voting model relied heavily on token holdings – whoever held more tokens, wielded more power. This approach, while simple, often led to plutocracy and passive governance. Enter DAO voting NFTs: non-fungible badges that encode a member’s reputation, achievements, or specific roles within the organization. Platforms like Gitcoin DAO have pioneered this with “Kudos” NFTs, which serve as immutable proof of open-source contributions.

This shift enables DAOs to assign voting rights based on actual engagement, not just capital investment. For example, a project manager might earn a high-tier badge conferring more votes per proposal than a casual participant. These badges can be upgraded or earned through continued involvement, creating an incentive loop for meaningful participation.

Tradability: Unlocking Liquidity and New Incentives

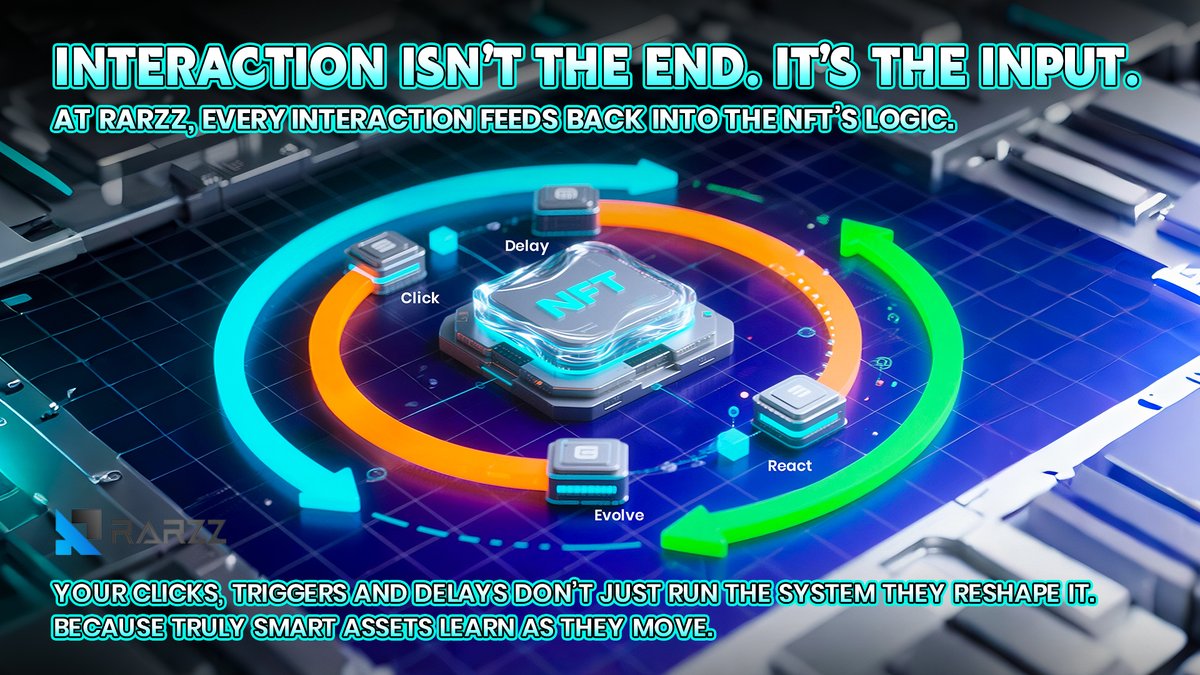

The game-changer? Many governance NFT badges are now tradable. This means voting rights themselves become liquid assets, buyable, sellable, and even rentable on emerging NFT voting rights marketplaces. Projects like Rarzz have taken this concept mainstream by allowing proposal voting rights to be wrapped as NFT tokens and exchanged freely.

This innovation unlocks new possibilities:

Key Benefits of Tradable Governance NFT Badges for DAOs

-

Meritocratic Voting Power: Tradable governance NFT badges allocate voting influence based on a member’s actual contributions and engagement, ensuring that active participants have a proportional say in DAO decisions. Example: Gitcoin DAO issues “Kudos” NFTs to recognize open-source contributors.

-

Transparent and Verifiable Governance: On-chain NFT badges serve as unique, tamper-proof credentials that verify member identities and contributions, reducing the risk of sybil attacks and fraudulent voting.

-

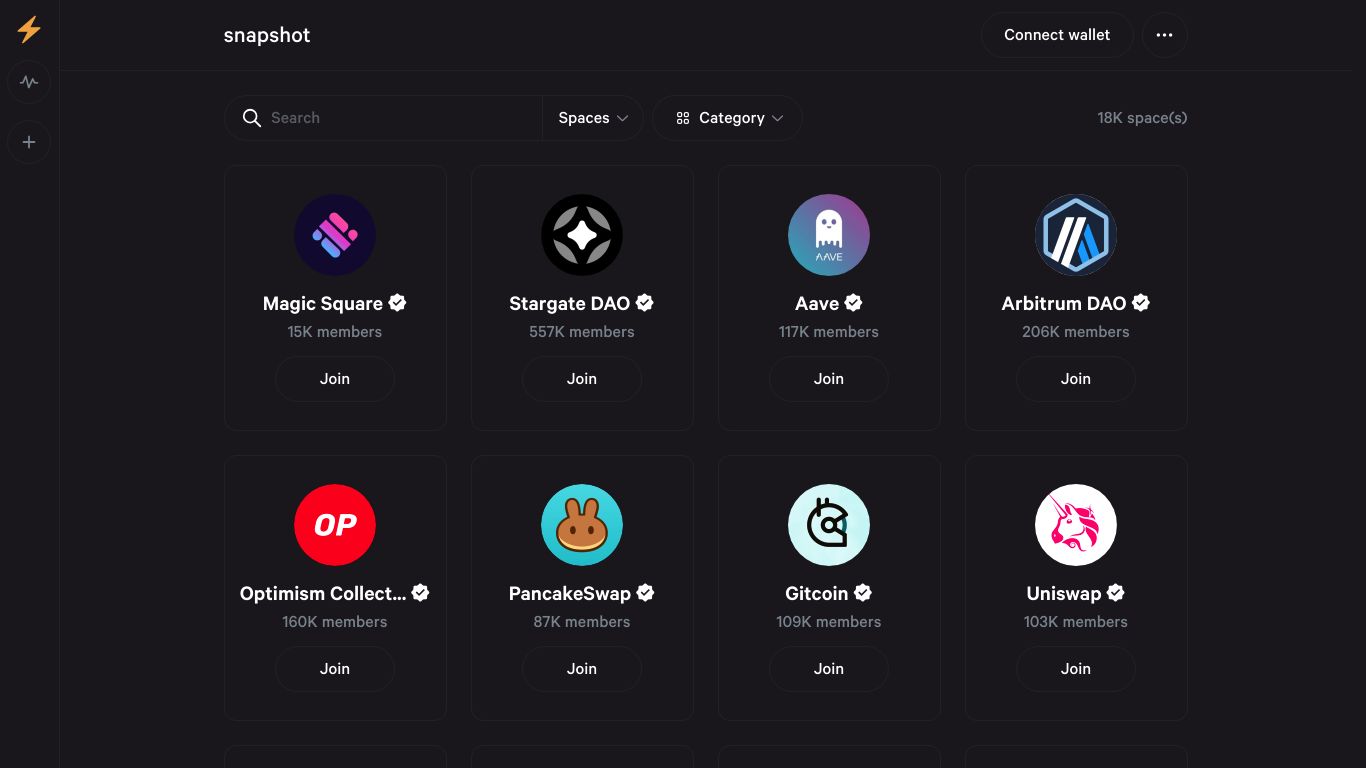

Flexible Integration with Voting Platforms: Governance NFT badges can be linked to platforms like Snapshot, enabling dynamic voting models such as role-based or tiered voting power, rather than simple token-weighted systems.

-

Incentivized Community Engagement: DAOs can use NFT badges to reward diverse forms of participation—coding, moderating, project management—driving deeper member involvement and sustained ecosystem growth.

-

Tradability and Liquidity: The ability to trade governance badges on NFT marketplaces like OpenSea introduces liquidity to governance rights, allowing members to enter or exit DAO influence positions more efficiently.

Tokenized governance influence introduces both opportunities and risks. On one hand, contributors can monetize their reputational capital or transfer influence when stepping back from active participation. On the other hand, unchecked trading could lead to power concentration if whales accumulate high-tier badges en masse, a challenge some DAOs address with soulbound (non-transferable) alternatives for key roles.

Transparency and Trust: Preventing Sybil Attacks and Fraudulent Voting

A core advantage of NFT-based governance systems is their ability to enhance trust in decentralized decision-making. Each badge acts as an on-chain identity marker, preventing duplicate accounts (Sybil attacks) and ensuring that every vote originates from a verified contributor. This transparency is essential for scaling DAOs beyond small communities into robust organizations with thousands of stakeholders.

The integration of these NFTs with popular Web3 platforms like Snapshot further amplifies their utility. DAOs can implement nuanced voting models, role-based weighting, quadratic voting based on badge tiers, or even time-locked influence, all enforced transparently via smart contracts. For an in-depth look at how these systems enhance both power distribution and reputation management in DAOs, see our guide on how governance NFT badges enhance DAO voting power and reputation systems.

Pioneers and Use Cases: Real-World Adoption Across Web3 Sectors

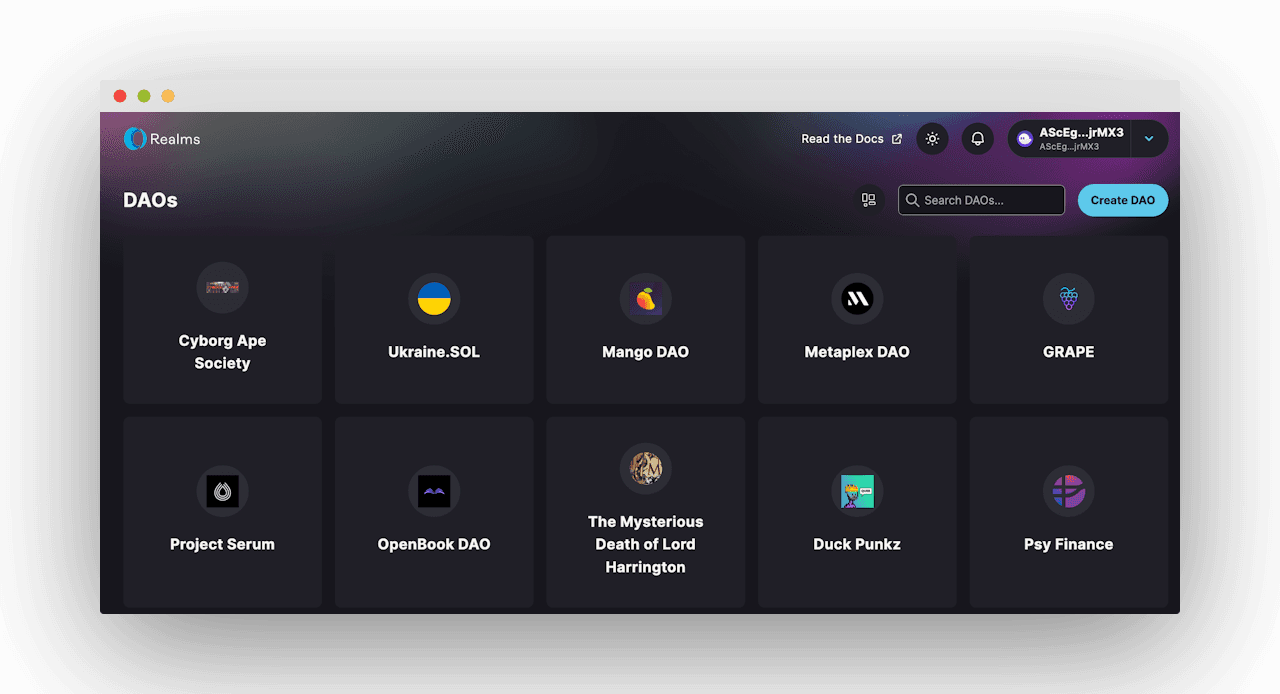

The adoption curve for tradable governance NFTs is steepening across diverse sectors, from DeFi protocols rewarding liquidity providers with income-generating NFTs to gaming guilds issuing custom badges that unlock cross-platform perks. In esports and content creation verticals, streamers drop exclusive passes granting fans both access privileges and participatory rights within creator DAOs.

Meanwhile, DAO-enabled NFT platforms are pushing the envelope by combining collective governance with decentralized asset management. Projects like Mintable’s $MINT NFT-DAO have demonstrated how trading badges on open marketplaces or through bonding curves can directly increase a member’s voting weight, blending market-driven economics with community-driven decision-making. This has opened up a new asset class where income-generating NFTs are not just collectibles but instruments of real organizational influence.

The flexibility of tradable governance NFT badges also enables DAOs to experiment with hybrid models. Some projects issue both transferable and non-transferable badges, balancing the liquidity and incentive alignment of tradable assets with the security and integrity of soulbound credentials. By leveraging programmable smart contracts, DAOs can set custom rules, such as vesting schedules, time-limited voting power, or automatic badge upgrades, further tailoring governance to their unique needs.

Risks and Ethical Considerations: Power Dynamics in a Tokenized World

Despite their promise, tokenized governance influence is not without controversy. The ability to buy or sell voting rights raises questions about plutocracy, collusion, and the commodification of community trust. If left unchecked, whales could potentially manipulate outcomes by amassing high-tier governance NFTs. To mitigate this risk, leading DAOs are exploring mechanisms such as:

- Reputation decay: Badges lose influence if not actively used or maintained.

- Capped accumulation: Limits on the number or level of badges any single address can hold.

- KYC/identity verification: Ensuring that each badge corresponds to a unique individual rather than a pseudonymous wallet farm.

This evolving landscape demands continuous experimentation and agile policy updates as new attack vectors, and new forms of engagement, emerge.

DAOs Succeeding with Hybrid Governance Badge Systems

-

Gitcoin DAO issues Kudos NFT badges to contributors, directly linking reputation and on-chain impact to voting power. This hybrid system rewards active participation and integrates with platforms like Snapshot for dynamic governance.

-

BanklessDAO utilizes role-based NFT badges to assign governance rights. Members earn badges for editorial, operational, or leadership roles, which unlock specific voting privileges and responsibilities within the DAO.

-

Rarzz implements tradable governance NFT badges that package proposal voting rights as NFTs. These badges are bought, sold, or earned, making governance power both merit-based and liquid, while maintaining transparency on-chain.

-

Mintable ($MINT) NFT-DAO employs a hybrid badge and token system where users gain additional voting rights by trading on the Mintable marketplace or holding governance NFTs, blending activity-based rewards with tradable influence.

-

SuperRare DAO leverages curation and participation NFT badges to grant voting rights for platform decisions. These badges recognize active artists and curators, ensuring governance reflects ongoing community contributions.

The Future Outlook: Programmable Governance at Scale

The next frontier for Web3 governance tools lies in composability: integrating tradable governance NFT badges with other DeFi primitives, social graphs, and cross-chain identity layers. Imagine a world where your contributions in one DAO automatically enhance your reputation, and voting power, in another; or where badges unlock both digital rights and real-world benefits across partner ecosystems. This interoperability will be key to scaling decentralized organizations beyond niche communities into global networks.

As DAOs mature and regulatory clarity improves, expect to see more sophisticated marketplaces emerge for NFT voting rights, complete with lending protocols, fractionalization options, and even derivatives trading on future governance outcomes. The convergence of verifiable credentials and liquid markets is already reshaping how value flows within decentralized ecosystems.

The bottom line? Tradable governance NFT badges are not just technical novelties, they’re foundational building blocks for transparent, adaptive, and meritocratic organizations in Web3. By thoughtfully designing these systems, and embracing both their opportunities and risks, DAOs can unlock unprecedented levels of participation while keeping power accountable to those who earn it.