In the evolving landscape of decentralized autonomous organizations, tradeable governance NFTs are emerging as a game-changer, allowing DAOs to package voting rights and reputation into sellable badges that anyone can buy, sell, or hold. Imagine turning your hard-earned contributions in a DAO into a liquid asset that not only signals your status but also carries real decision-making weight. This isn’t just hype; it’s a practical evolution addressing the pitfalls of fungible token voting, where whales dominate and sybils dilute participation.

Projects like MeritDAOcracy are leading the charge, issuing badges for completed bounties that boost voting power. These DAO voting badges create meritocratic systems where influence aligns with action, not just token holdings. But tradability adds a twist: holders can cash out their governance stake, injecting liquidity into what was once a sticky commitment.

Breaking Free from Token Voting Pitfalls

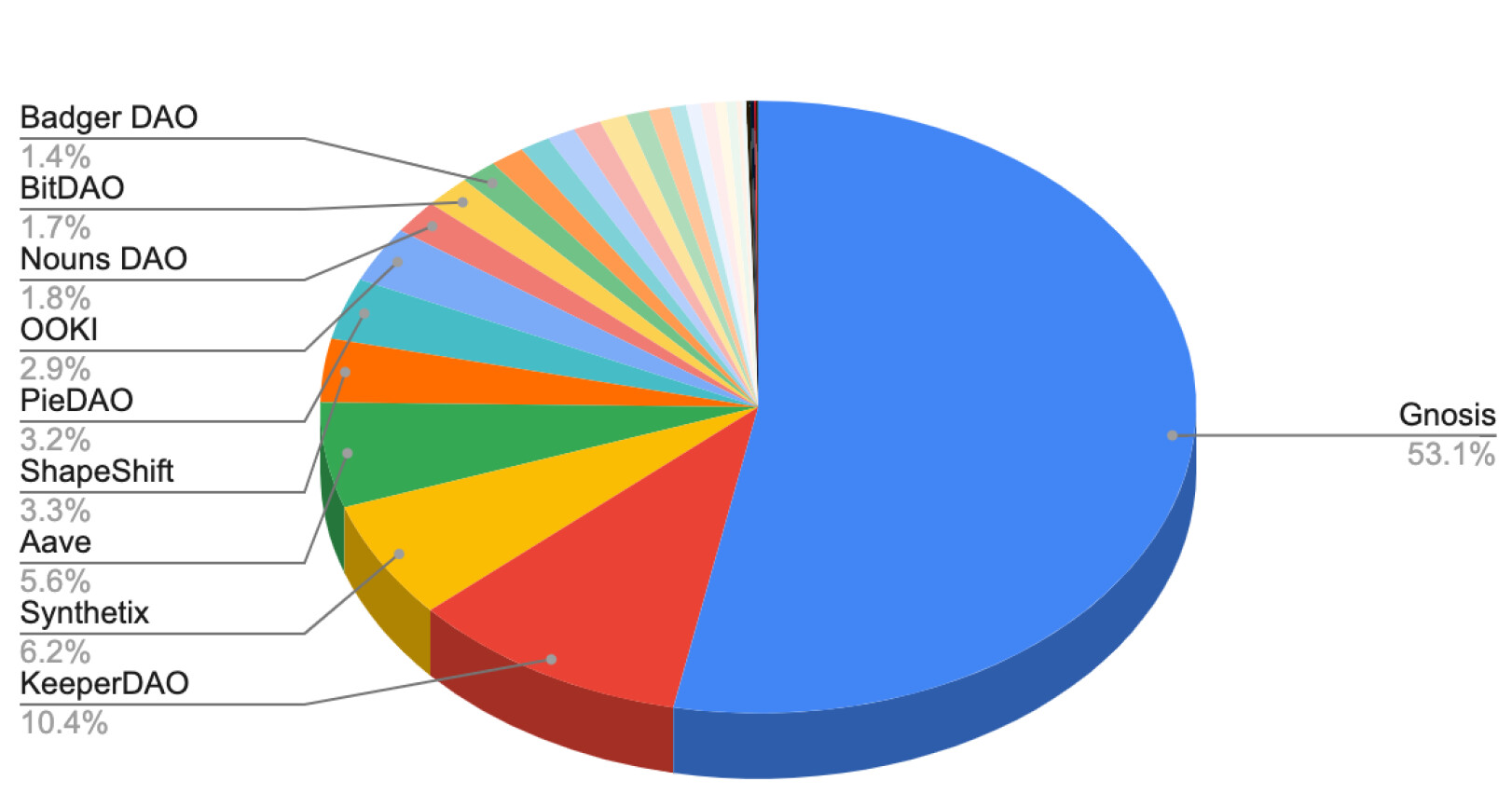

Traditional governance tokens have a glaring flaw. They’re prone to centralization as large holders amass control, and Sybil attacks let bad actors spin up fake identities to sway votes. The updated DAO landscape shows governance NFTs tackling this head-on by tying rights to verifiable contributions. As noted in recent analyses from ChainScore Labs, these NFTs form the backbone of DAOs, though they introduce a liquidity versus composability trade-off worth unpacking.

Soulbound tokens (SBTs) offered a counterpoint with non-transferable identity proofs, transforming membership as Outlook India highlights. Yet, their rigidity locks in reputation without market dynamics. Enter tradeable governance NFTs: they blend reputation signaling with liquidity, echoing a16z crypto’s framework of paired tokens, one for reputation and another for tradability.

DAOs create trust through NFTs auctioned from completed works, funding cycles while tokens claim revenues.

This shift empowers contributors to monetize their standing, fostering deeper engagement. DeepDAO’s tools reveal how such structures enhance decision-making transparency across ecosystems.

Bundling Reputation and Voting into Liquid Positions

At its core, a DAO reputation NFT bundles metrics like bounty completions, forum activity, or milestone achievements into a single, on-chain badge. Tradability turns these into liquid governance positions, where buyers acquire not just votes but proven influence. Karma’s model, akin to Soulbound Labs, issues badges based on DAO-specified metrics, but making them sellable unlocks new possibilities.

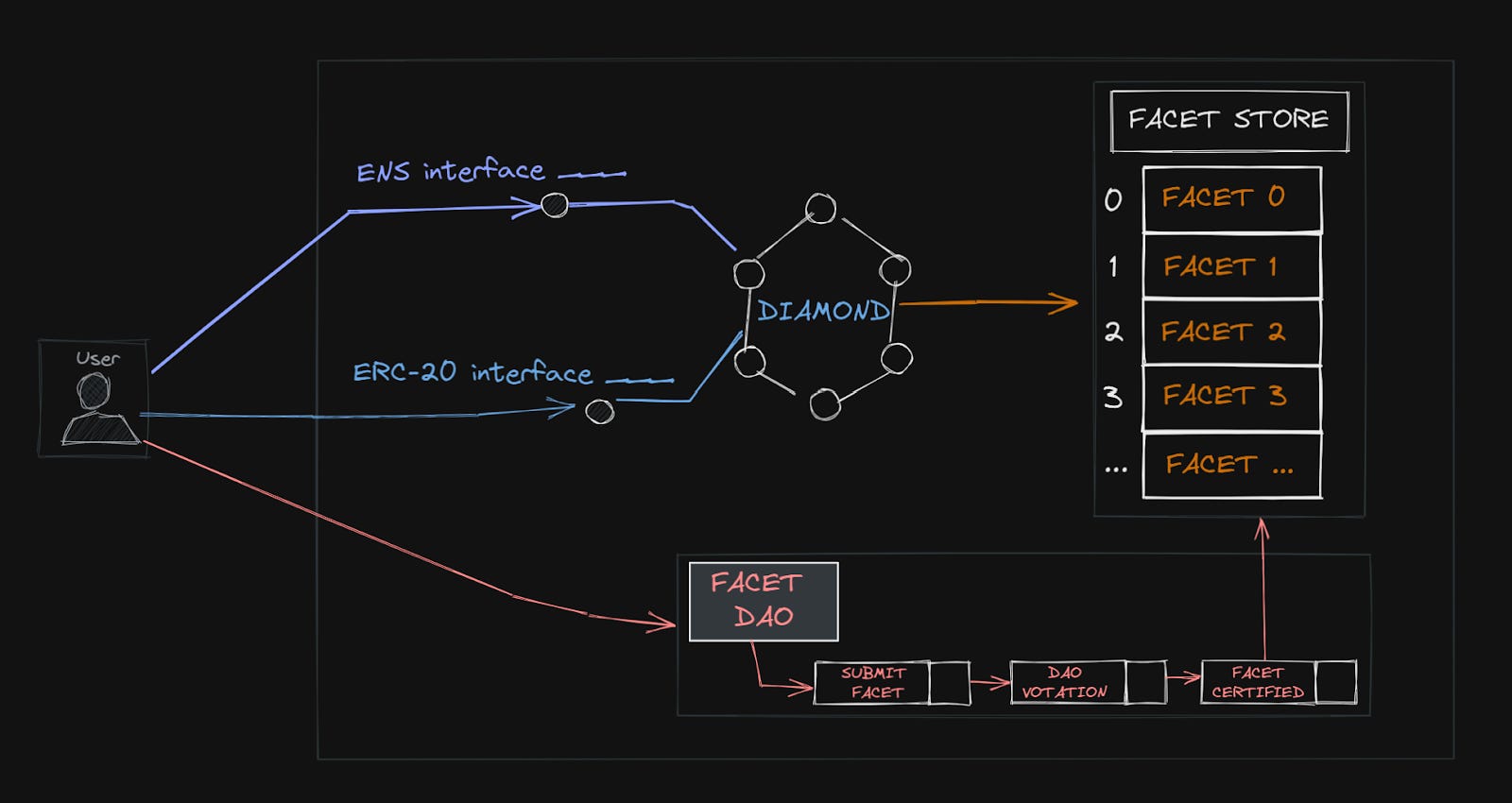

Consider media DAOs from SettleMint: creative works become NFTs, sales fund iterations, and governance badges represent voting power. Investors can now buy into portfolios via indexes or DAOs, as Cambridge University Press outlines, extending to governance stakes. This composability lets badges stack for amplified power or fractionalize for broader access.

Practically, DAOs implement reputation decay to prevent hoarding, capped accumulation, and identity checks, mitigating commodification risks. Wealthy buyers could concentrate power, but decay ensures active stewardship. For web3 communities, this means verifiable credentials that boost participation without soulbound lock-in.

Navigating Risks in the Tradable Era

Tradability isn’t without dilemmas. Raphael Spannocchi’s Medium piece on soulbound tokens flags similar issues: badges as public goods risk private alpha exploitation. In governance, selling votes could undermine meritocracy, echoing real estate NFT debates on Reddit where legal wrappers like LLCs legitimize assets.

Yet, the upsides shine in practice. ResearchGate’s NFT survey spans applications from gaming to identity, proving standards like ERC-721 underpin robust systems. Twitter buzz around achievement badges, like ‘MIT Admitted’ signals, shows crypto’s innovative edge. Governance NFT Badges platforms streamline issuance, verification, and trading, perfect for DAOs rewarding contributors.

To implement, start with clear metrics: define what earns a badge, set decay rates, and integrate marketplaces. This creates NFT governance tokens that evolve with the community, balancing liquidity’s allure against governance integrity. As DAOs mature, these sellable badges could redefine decentralized power dynamics.

Platforms like Governance NFT Badges make this straightforward, offering tools to mint, verify, and trade these assets seamlessly. From my vantage as a DAO governance specialist, I’ve seen firsthand how liquid governance positions invigorate communities, drawing in speculators who later become stewards.

Case Studies: DAOs Thriving with Tradeable Badges

Take MeritDAOcracy, where badges earned through bounties directly scale voting weight. Contributors cash out after a big push, funding personal ventures while new buyers step in with fresh energy. DeepDAO’s analytics show these DAOs boasting higher proposal throughput and lower voter apathy compared to token-only setups.

Comparison of DAO Governance Models

| Governance Model | Liquidity 💧 | Sybil Resistance 🔒 | Merit Alignment ⭐ | Composability 🔗 |

|---|---|---|---|---|

| Token Voting | ✅ High | ❌ Low | ❌ Low | ✅ High |

| Soulbound Tokens | ❌ Low | ✅ High | ✅ High | ❌ Low |

| Tradeable Governance NFTs | ✅ High | ⚠️ Medium | ✅ High | ⚠️ Medium |

This table underscores why DAO reputation NFTs strike the optimal balance. In creative DAOs, as SettleMint describes, auctioning NFT works feeds revenue back via governance badges, creating self-sustaining loops. Investment DAOs evolve further, letting holders vote on portfolio shifts much like ETF proxies, but fully on-chain.

Challenges persist, sure. Power concentration looms if unchecked, but mechanisms like reputation decay, where inactive badges lose potency over time, keep things merit-driven. Pair that with identity verification via zero-knowledge proofs, and you’ve got a system resilient to whales buying dominance.

Practical Steps to Launch Your Own

Getting started doesn’t require rocket science. First, audit your DAO’s metrics: forum posts, code commits, event attendance. Map these to badge tiers. Then, deploy on Ethereum or Polygon using ERC-721 standards, integrating decay logic via smart contracts.

5 Steps to Issue Tradeable Governance NFT Badges

-

Define Metrics: Start by specifying clear, quantifiable criteria for badges, like bounty completions or voting participation. Draw from MeritDAOcracy protocols and DeepDAO benchmarks for meritocratic reputation.

-

Smart Contract Setup: Code and deploy an ERC-721 contract on Ethereum using OpenZeppelin libraries. Embed minting logic tied to on-chain proofs of contributions.

-

Marketplace Integration: Link your NFTs to OpenSea or Blur via contract approvals, unlocking trading of voting rights and reputation for liquidity.

-

Decay Mechanisms: Add time-based decay, like quarterly halving of voting power, to combat hoarding. Inspired by a16z crypto reputation frameworks for sustained engagement.

-

Community Rollout: Propose via DAO vote, airdrop badges to active members, and announce on Discord or X to bootstrap adoption and feedback.

Integrate with marketplaces like OpenSea or dedicated DAO hubs for liquidity. Test with a pilot cohort to iron out kinks. For deeper dives, check out resources on issuing tradeable governance NFT badges. I’ve advised three DAOs on this, and the liquidity bump alone justified the effort.

Beyond mechanics, these badges foster cultural shifts. Contributors view governance as investable capital, not sunk cost. Buyers gain skin in the game, aligning incentives across holders. ResearchGate’s NFT survey validates this across sectors, from gaming quests to supply chain proofs.

Looking ahead, as 2026 unfolds, expect hybrid models blending SBTs for core identity with tradeable layers for liquid stakes. a16z’s dual-token vision points here: reputation signals paired with liquidity wrappers. Cambridge’s NFT future chapter nods to DAO indexes pooling these assets, democratizing access further.

In practice, this means DAOs like those tracked by DeepDAO will see treasury growth from badge royalties, funding bolder initiatives. Risks? Sure, but mitigated designs turn them into features. Tradeable governance NFTs aren’t perfect, yet they propel DAOs toward resilient, vibrant governance that rewards real sweat equity while welcoming market forces. Platforms ready to equip you abound, dive in and badge up your community.