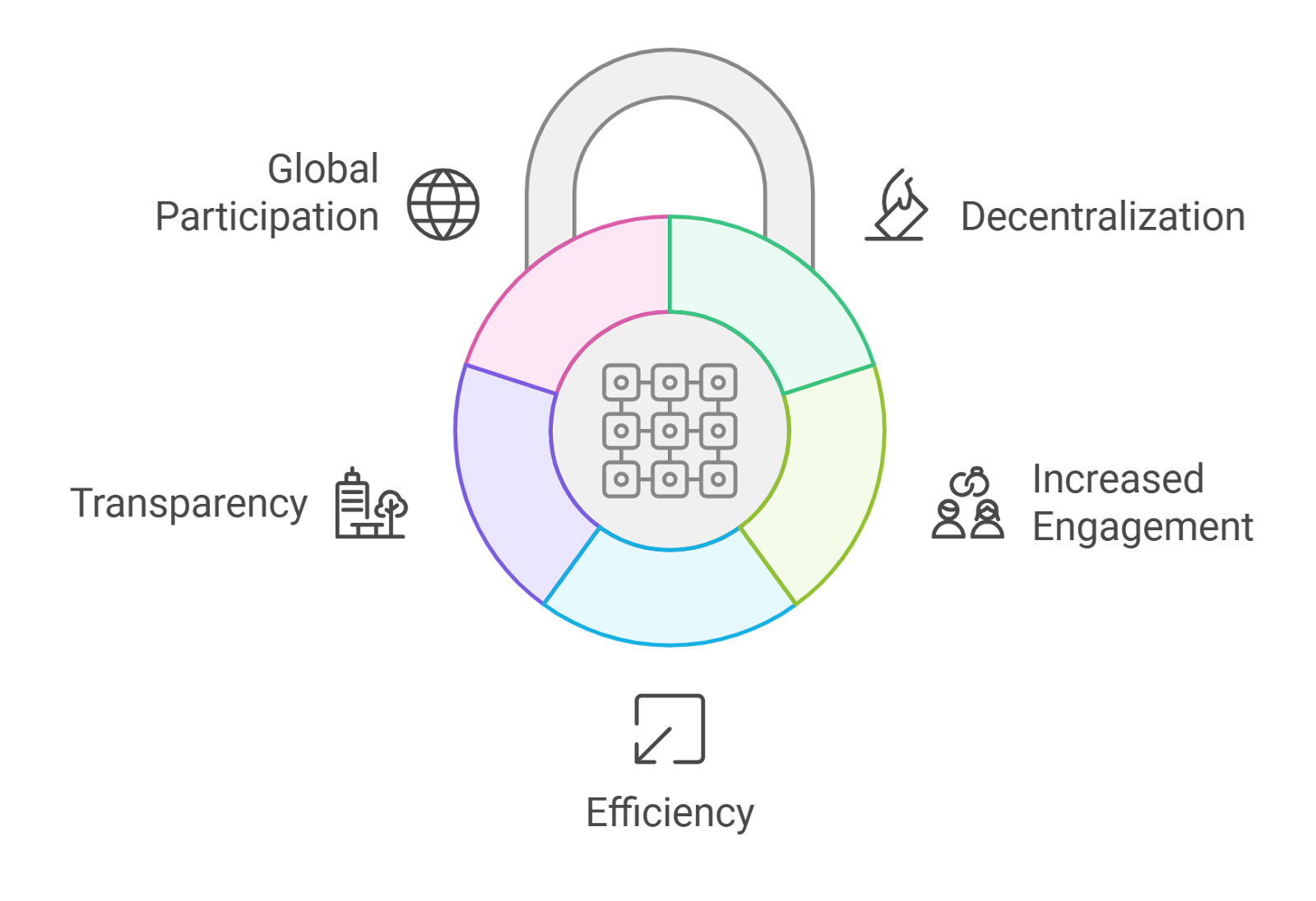

Tradable governance NFT badges are rapidly redefining how Decentralized Autonomous Organizations (DAOs) structure participation and distribute voting power. Unlike traditional governance tokens, which often lead to power concentration among a handful of large holders, these NFT-based badges introduce a meritocratic and dynamic approach to influence. Each badge is a verifiable, on-chain credential that recognizes individual contributions, roles, or achievements within a DAO, making the assignment of voting rights more transparent, flexible, and aligned with actual community engagement.

From Static Tokens to Dynamic Participation

The classic model for DAO voting relies on fungible governance tokens: 1 token equals 1 vote. While simple, this approach often rewards early investors or deep-pocketed whales rather than active contributors. Tradable governance NFT badges disrupt this paradigm by making voting power dynamic and responsive to real-world actions. For instance, DAOs can issue badges for specific achievements, such as completing critical tasks, providing liquidity, moderating forums, or leading working groups. These badges can then be bought, sold, or even leased on open marketplaces.

This shift incentivizes ongoing participation and unlocks new forms of engagement. In practice:

- DeFi protocols reward liquidity providers with income-generating NFTs that grant both yield and voting rights.

- Gaming guilds issue custom badges that unlock cross-platform perks and unique governance privileges.

- Creator DAOs allow fans to purchase exclusive passes for participatory rights in content decisions.

The result? Voting weight is increasingly tied to recent activity and concrete contributions rather than static token holdings, a trend that’s making DAOs more resilient and adaptive.

Enhancing Transparency and Trust in Web3 Governance

A key advantage of NFT-based governance systems is their ability to enhance trust in decentralized decision-making. Each badge functions as an on-chain identity marker, significantly reducing the risk of Sybil attacks (where one user creates multiple accounts for extra votes) by verifying that every vote comes from a legitimate contributor. This transparency is vital as DAOs scale from small collectives into organizations with thousands of stakeholders.

The data-driven nature of NFT credentials also supports granular reputation systems. Contributors can showcase their badges as proof of expertise or impact across multiple communities, a feature that’s particularly valuable in the competitive landscape of Web3 talent acquisition. For more on the mechanics behind these systems, see our comprehensive guide on how DAOs use NFT badges to assign voting power and track contributions.

Diverse Real-World Adoption: DeFi, Gaming, Content Creation

The adoption curve for tradable governance NFTs is steepening across several verticals:

- DeFi: Protocols like RootstockCollective distribute limited edition NFTs that unlock not just voting capabilities but also BTC-based rewards.

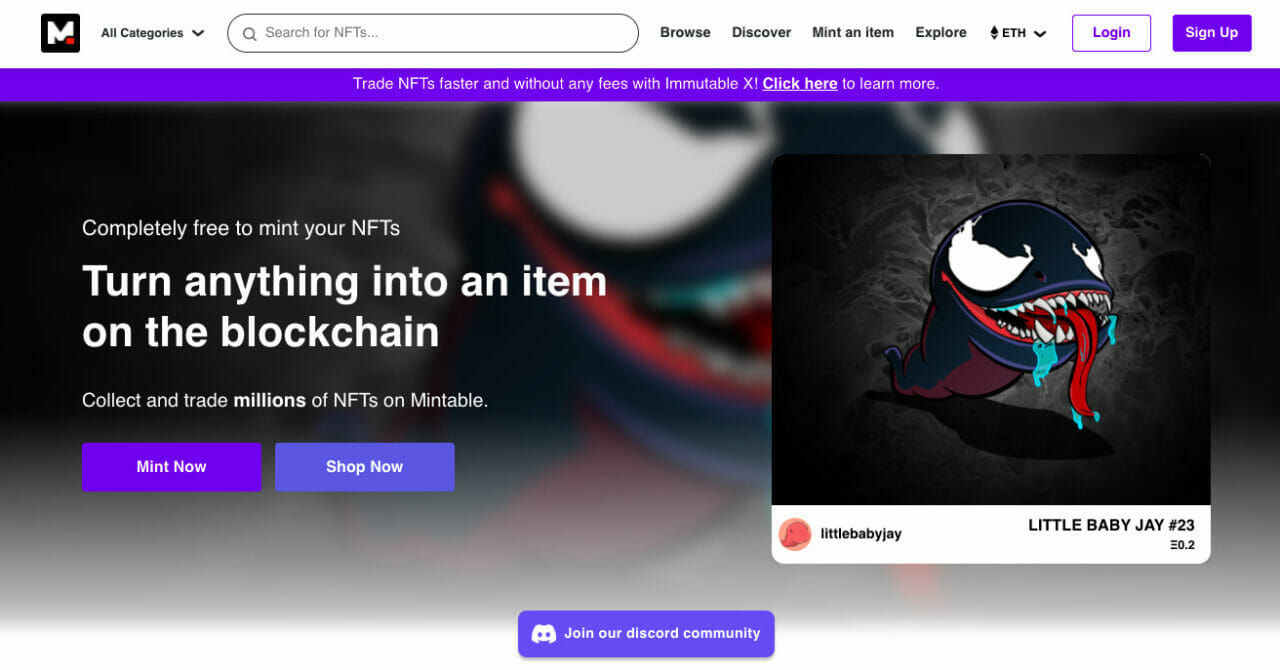

- NFT Marketplaces: Mintable’s $MINT DAO lets users trade governance badges directly on its platform, voting weight increases with marketplace activity, blending market-driven incentives with democratic control.

- Content Platforms: Streamers offer exclusive NFT passes granting both access privileges and participatory rights in creator DAOs, a model that boosts fan loyalty while decentralizing creative decisions.

This multi-sector adoption underscores the flexibility of NFT-based credentials: they serve as both status symbols and functional tools for community engagement. According to recent research from Digital Currency Traders, NFTs are now being used not only for voting but also for discounts on club access and influence over platform development, demonstrating their growing utility as core Web3 governance tools.

Navigating Risks: Plutocracy vs Meritocracy

The rise of tradable governance NFTs introduces new ethical challenges alongside its benefits. The ability to buy or sell voting rights raises concerns about plutocracy (rule by the wealthy), collusion between large holders, and the commodification of community trust. To address these risks:

- Reputation Decay: Some DAOs implement time-based decay so that unused badges lose influence over time.

- Capped Accumulation: Limits are placed on how many high-impact badges any single address can hold, reducing the risk of vote hoarding.

- KYC/Identity Verification: Increasingly common in larger DAOs to ensure one badge equals one real participant, not just another wallet controlled by a single entity.

This evolving landscape requires continuous experimentation with mechanisms that balance liquidity with fairness, a topic we explore further in our resource on how tradable governance NFT badges are reshaping DAO voting power and influence.

As DAOs experiment with these governance badge systems, the line between meritocracy and market-driven influence is being actively negotiated. The most successful implementations are those that combine the flexibility of tradable NFTs with robust guardrails, ensuring that voting rights reflect genuine community participation rather than unchecked financial power.

Hybrid Models: Where Tradability Meets Accountability

Some leading DAOs are pioneering hybrid approaches, blending tradable NFT badges with reputation-based or role-specific controls. For example, Gitcoin DAO issues Kudos NFT badges that tie on-chain activity to voting weight, while BanklessDAO leverages role-based NFTs to reward sustained contributions. SuperRare DAO recognizes active artists and curators through curation badges that translate into tangible voting influence.

This hybridization allows communities to maintain the liquidity and dynamism of NFT markets while preserving accountability and reducing manipulation risk. By integrating features like time-locked badges, non-transferable credentials for key roles, or staking requirements for high-impact votes, DAOs can further align incentives with long-term engagement.

What’s Next for NFT Voting Rights?

The future of NFT voting rights is likely to involve even more granular customization. Expect to see:

- Staking governance NFTs: Members stake their badges to signal commitment, earning additional influence or rewards based on lock-up periods.

- Leasing NFT voting power: Temporary delegation of badge rights for specific proposals or timeframes, creating new incentive structures for expertise and collaboration.

- Cross-DAO reputation systems: Badges earned in one organization may unlock privileges in another, building portable Web3 resumes and fostering broader ecosystem alignment.

This evolution will require ongoing technical development as well as robust policy frameworks to ensure fairness and prevent abuse. As experimentation continues across sectors, from DeFi protocols to creator collectives, the most resilient DAOs will be those that treat governance as a living system: adaptable, transparent, and always open to iteration.

Key Benefits & Challenges of Tradable Governance NFT Badges in DAOs

-

Dynamic, Merit-Based Voting Power: Tradable governance NFT badges enable DAOs to assign voting rights based on individual contributions and achievements, rather than simply token holdings. This fosters a more meritocratic and engaged community.

-

Enhanced Transparency & Sybil Resistance: Each NFT badge serves as a verifiable on-chain identity, making it harder for bad actors to manipulate votes through duplicate accounts. This boosts trust and fairness in DAO decisions.

-

Market-Driven Liquidity & Flexibility: Tradable badges allow members to buy, sell, or earn voting power on open marketplaces, as seen in projects like Mintable ($MINT) NFT-DAO. This introduces liquidity and flexibility to governance participation.

-

Risk of Plutocracy & Collusion: The ability to trade badges can concentrate voting power among wealthy participants, raising concerns about plutocracy, collusion, and the commodification of trust within DAOs.

-

Mitigation Mechanisms in Leading DAOs: Top DAOs like Gitcoin DAO and BanklessDAO implement controls such as reputation decay, capped badge accumulation, and KYC verification to reduce abuse and maintain fairness.

-

Sector-Wide Adoption & Versatility: Governance NFT badges are being adopted across DeFi, gaming, and content creation sectors, with platforms like SuperRare DAO and Rarzz using badges to reward active participation and curate decision-making power.

Action Steps for DAO Builders

If you’re considering integrating tradable governance NFT badges into your DAO’s structure, focus on these actionable strategies:

- Define clear issuance criteria: Make sure each badge corresponds to measurable contributions or roles.

- Set accumulation limits: Prevent concentration of power by capping badge holdings per address.

- Pilot reputation decay mechanisms: Regularly review badge activity and reduce influence for inactive holders.

- Pursue transparency: Use on-chain verification tools so every vote can be traced back to a verified contributor.

- Explore real-world case studies: Learn from projects already leveraging these tools at scale.

The era of static token-based governance is fading as DAOs embrace more dynamic models powered by NFT credentials. By thoughtfully deploying tradable governance badges, and continuously refining their systems, Web3 organizations can create fairer, more participatory ecosystems where influence flows from action rather than mere capital allocation.